Question: Amalgamated Eurythmics (AE) is deciding whether or not it should manufacture dagons spheres to take advantage of a new fad. To get underway, the project

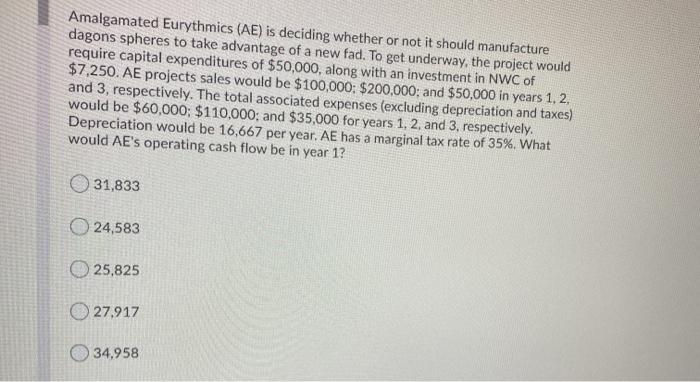

Amalgamated Eurythmics (AE) is deciding whether or not it should manufacture dagons spheres to take advantage of a new fad. To get underway, the project would require capital expenditures of $50,000, along with an investment in NWC of $7,250. AE projects sales would be $100,000: $200,000; and $50,000 in years 1, 2, and 3, respectively. The total associated expenses (excluding depreciation and taxes) would be $60,000; $110,000: and $35,000 for years 1, 2and 3, respectively. Depreciation would be 16,667 per year. AE has a marginal tax rate of 35%. What would AE's operating cash flow be in year 1? 31,833 24,583 25,825 27.917 34,958

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts