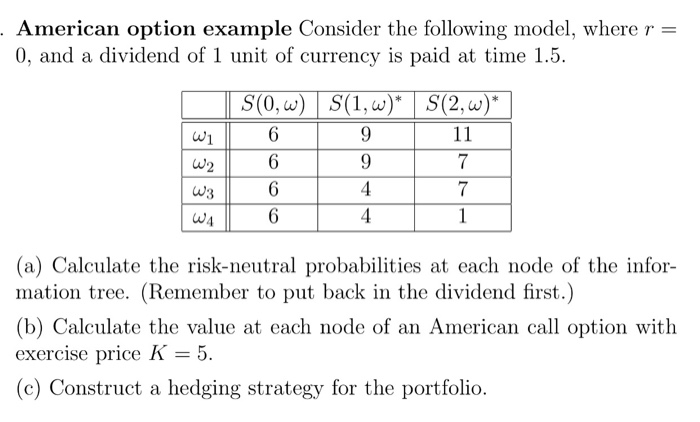

Question: American option example American option example Consider the following model, where r - 0, and a dividend of 1 unit of currency is paid at

American option example Consider the following model, where r - 0, and a dividend of 1 unit of currency is paid at time 1.5. w1 6 W3 WA (a) Calculate the risk-neutral probabilities at each node of the infor- mation tree. (Remember to put back in the dividend first.) (b) Calculate the value at each node of an American call option with exercise price K = 5. (c) Construct a hedging strategy for the portfolio. American option example Consider the following model, where r - 0, and a dividend of 1 unit of currency is paid at time 1.5. w1 6 W3 WA (a) Calculate the risk-neutral probabilities at each node of the infor- mation tree. (Remember to put back in the dividend first.) (b) Calculate the value at each node of an American call option with exercise price K = 5. (c) Construct a hedging strategy for the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts