Question: Ameritrade Case report: Assignment 1. Using price, dividend, and split data (Exhibit 5) calculate monthly returns from Mar-92 to Aug-97 for the following firms: Ameritrade,

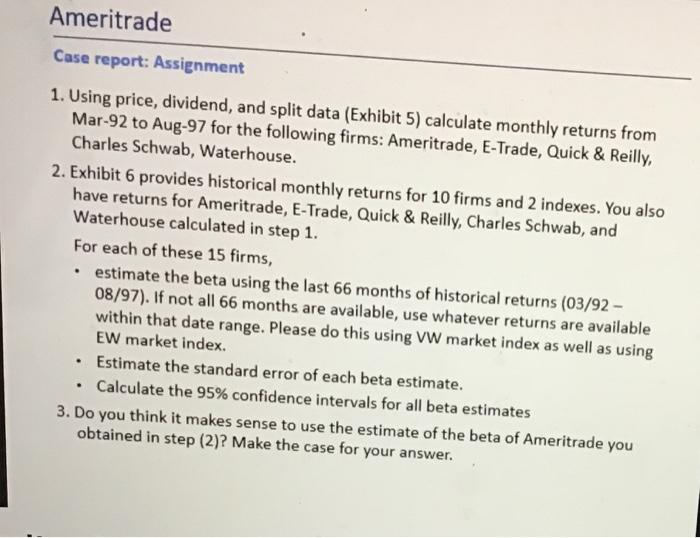

Ameritrade Case report: Assignment 1. Using price, dividend, and split data (Exhibit 5) calculate monthly returns from Mar-92 to Aug-97 for the following firms: Ameritrade, E-Trade, Quick & Reilly, Charles Schwab, Waterhouse. 2. Exhibit 6 provides historical monthly returns for 10 firms and 2 indexes. You also have returns for Ameritrade, E-Trade, Quick & Reilly, Charles Schwab, and Waterhouse calculated in step 1. For each of these 15 firms, estimate the beta using the last 66 months of historical returns (03/92 - 08/97). If not all 66 months are available, use whatever returns are available within that date range. Please do this using VW market index as well as using EW market index. Estimate the standard error of each beta estimate. Calculate the 95% confidence intervals for all beta estimates 3. Do you think it makes sense to use the estimate of the beta of Ameritrade you obtained in step (2)? Make the case for your answer. . . Ameritrade Case report: Assignment 1. Using price, dividend, and split data (Exhibit 5) calculate monthly returns from Mar-92 to Aug-97 for the following firms: Ameritrade, E-Trade, Quick & Reilly, Charles Schwab, Waterhouse. 2. Exhibit 6 provides historical monthly returns for 10 firms and 2 indexes. You also have returns for Ameritrade, E-Trade, Quick & Reilly, Charles Schwab, and Waterhouse calculated in step 1. For each of these 15 firms, estimate the beta using the last 66 months of historical returns (03/92 - 08/97). If not all 66 months are available, use whatever returns are available within that date range. Please do this using VW market index as well as using EW market index. Estimate the standard error of each beta estimate. Calculate the 95% confidence intervals for all beta estimates 3. Do you think it makes sense to use the estimate of the beta of Ameritrade you obtained in step (2)? Make the case for your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts