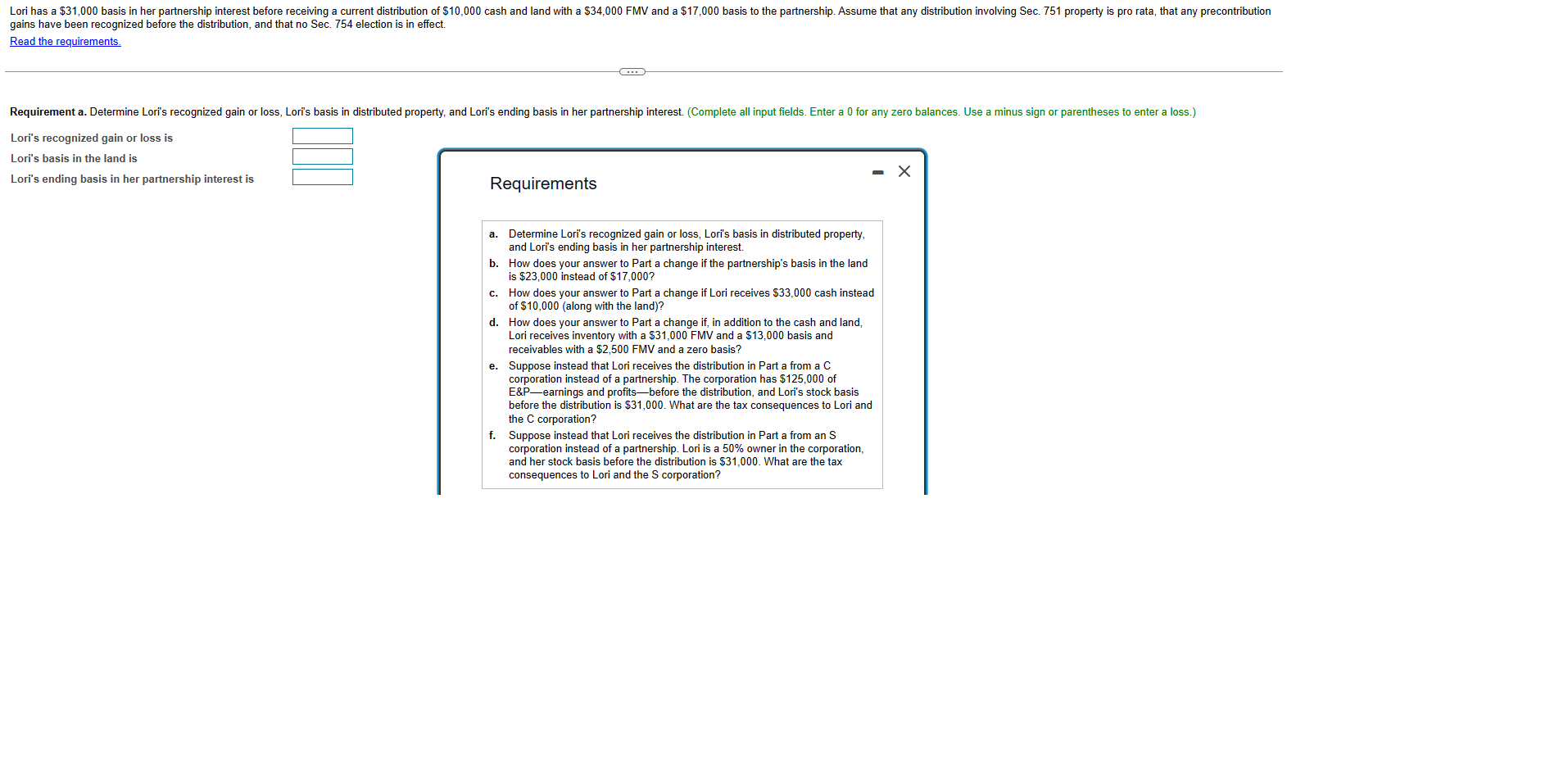

Question: Requirements a. Determine Lori's recognized gain or loss, Lori's basis in distributed property, and Lori's ending basis in her partnership interest. b. How does your

Requirements a. Determine Lori's recognized gain or loss, Lori's basis in distributed property, and Lori's ending basis in her partnership interest. b. How does your answer to Part a change if the partnership's basis in the land is $23,000 instead of $17,000 ? c. How does your answer to Part a change if Lori receives $33,000 cash instead of $10,000 (along with the land)? d. How does your answer to Part a change if, in addition to the cash and land, Lori receives inventory with a $31,000FMV and a $13,000 basis and receivables with a $2,500FMV and a zero basis? e. Suppose instead that Lori receives the distribution in Part a from a C corporation instead of a partnership. The corporation has $125,000 of E\&P_earnings and profits-before the distribution, and Lori's stock basis before the distribution is $31,000. What are the tax consequences to Lori and the C corporation? f. Suppose instead that Lori receives the distribution in Part a from an S corporation instead of a partnership. Lori is a 50% owner in the corporation, and her stock basis before the distribution is $31,000. What are the tax consequences to Lori and the S corporation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts