Question: Amortization Schedule 7 . 8 . Consider a $ 2 0 , 0 0 0 loan to be repaid in equal installments at the end

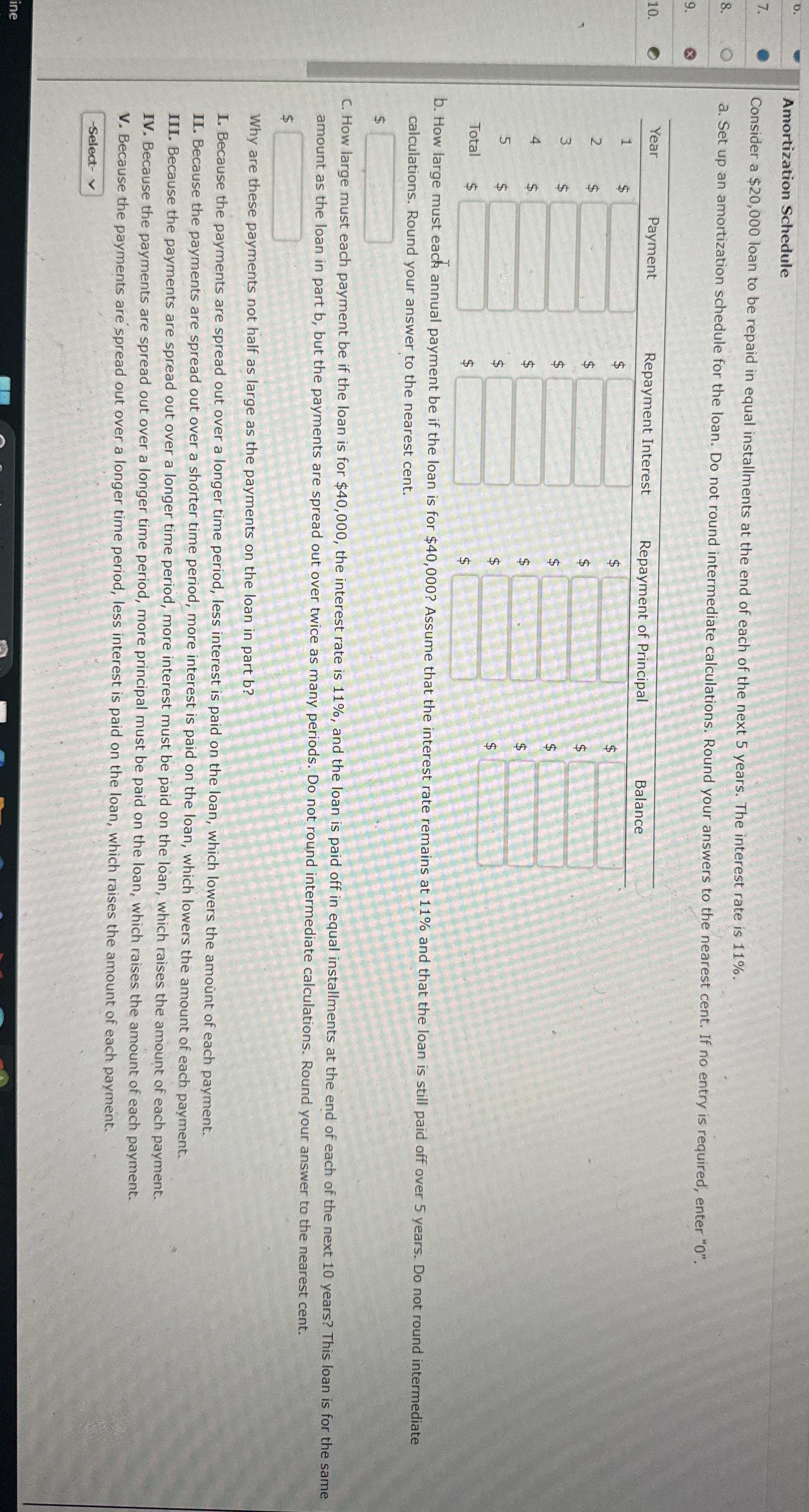

Amortization Schedule

Consider a $ loan to be repaid in equal installments at the end of each of the next years. The interest rate is

a Set up an amortization schedule for the loan. Do not round intermediate calculations. Round your answers to the nearest cent. If no entry is required, enter

tableYearPayment,Repay,Repay,,Balance$$$$$$$$$$$$$$$$$$$$Total$$$ calculations. Round your answer to the nearest cent.

$ amount as the loan in part but the payments are spread out over twice as many periods. Do not round intermediate calculations. Round your answer to the nearest cent.

$ Why are these payments not half as large as the payments on the loan in part b

I. Because the payments are spread out over a longer time period, less interest is paid on the loan, which lowers the amount of each payment.

II Because the payments are spread out over a shorter time period, more interest is paid on the loan, which lowers the amount of each payment.

III. Because the payments are spread out over a longer time period, more interest must be paid on the loan, which raises the amount of each payment.

IV Because the payments are spread out over a longer time period, more principal must be paid on the loan, which raises the amount of each payment.

V Because the payments are spread out over a longer time period, less interest is paid on the loan, which raises the amount of each payment.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock