Question: Amortizing a bond discount: A. Allocates a part of the total discount to each interest period B. Increases the market value of the Bonds Payable

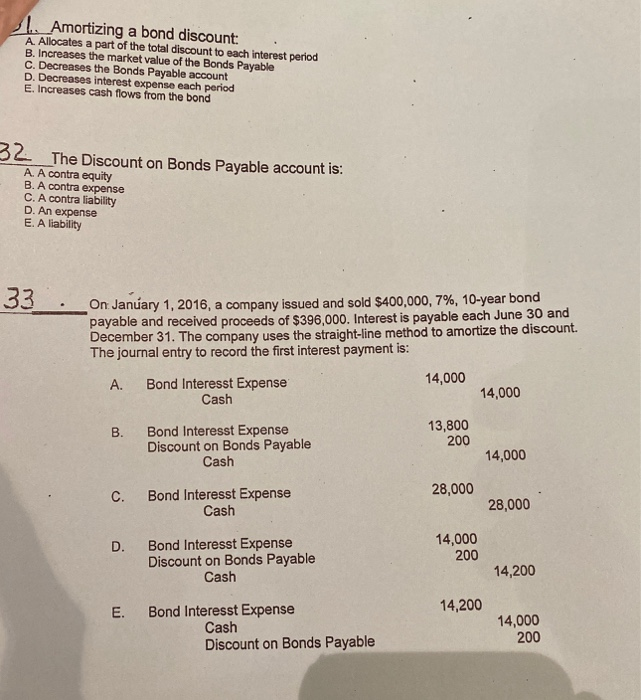

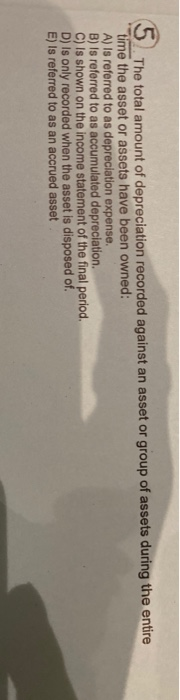

Amortizing a bond discount: A. Allocates a part of the total discount to each interest period B. Increases the market value of the Bonds Payable C. Decreases the Bonds Payable account D. Decreases interest expense each period E. Increases cash flows from the bond 32 The Discount on Bonds Payable account is: A. A contra equity B. A contra expense C. A contra liability D. An expense E. A liability 33 On: January 1, 2016, a company issued and sold $400,000, 7%, 10-year bond payable and received proceeds of $396,000. Interest is payable each June 30 and December 31. The company uses the straight-line method to amortize the discount. The journal entry to record the first interest payment is: 14,000 A. Bond Interesst Expense Cash 14,000 B. Bond Interesst Expense Discount on Bonds Payable Cash 13,800 200 14,000 C. 28,000 Bond Interesst Expense Cash 28,000 D. Bond Interesst Expense Discount on Bonds Payable Cash 14,000 200 14,200 E 14,200 Bond Interesst Expense Cash Discount on Bonds Payable 14,000 200 The total amount of depreciation recorded against an asset or group of assets during the entire time the asset or assets have been owned: A) Is referred to as depreciation expense. B) is referred to as accumulated depreciation. C) is shown on the income statement of the final period. D) is only recorded when the asset is disposed of. E) Is referred to as an accrued asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts