Question: Amortizing a bond discount will ___. decrease the unamortized bone discount increase the unamortized bond discount decrease the carrying value of the bond decrease the

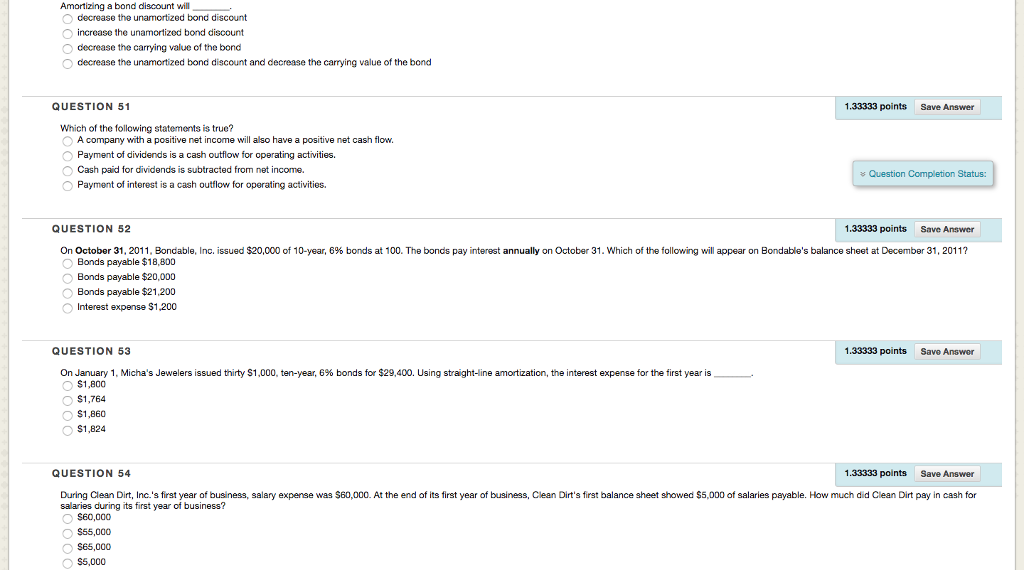

Amortizing a bond discount will ___. decrease the unamortized bone discount increase the unamortized bond discount decrease the carrying value of the bond decrease the unamortized bond discount and decrease the carrying value of the bond Which of the following statements is true? A company with a positive net income will also have a positive net cash flow. Payment of dividends is a cash outflow for operating activities. Cash paid for dividends is subtracted from net income. Payment of interest is a cash outflow for operating activities. On October 31, 2011. Bondable, Inc. issued $20,000 of 10-year, 6% bonds at 100. The bonds pay interest annually on October 31. Which of the following will appear on Bondage's balance sheet at December 31, 2011? Bonds payable $18, 800 Bonds payable $20,000 Bonds payable $21, 200 Interest expense $1, 200 On January 1, Micha's Jewelers issued thirty $1,000, ten-year, 6% bonds for $29, 400. Using straight-line amortization, the interest expense for the first year is ___. $1, 800 $1, 764 $1, 860 $1, 824 During Clean Dirt, Inc.'s first year of business, salary expense was $60,000. At the end of its first year of business, Clean Dirt's first balance sheet showed $5,000 of salaries payable. How much did Clean Dirt pay in cash for salaries during its first year of business? $60,000 $55,000 $65,000 $5,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts