Question: An accelerated depreciation method: 1. a. b. 2. C. d. results in reporting higher earnings every year depreciates assets over a longer life than

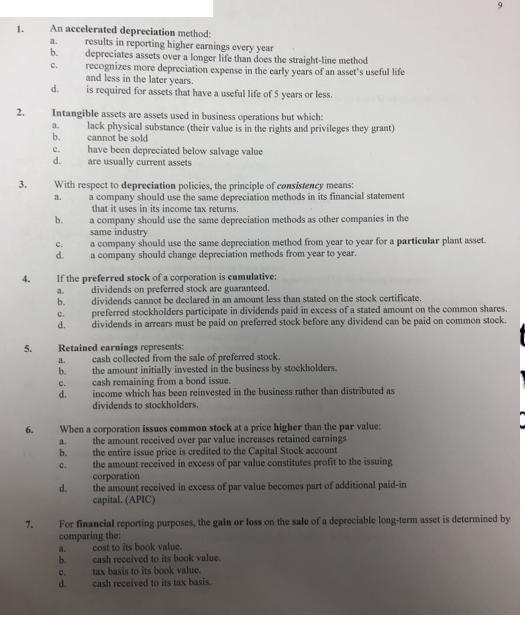

An accelerated depreciation method: 1. a. b. 2. C. d. results in reporting higher earnings every year depreciates assets over a longer life than does the straight-line method recognizes more depreciation expense in the early years of an asset's useful life and less in the later years. is required for assets that have a useful life of 5 years or less. Intangible assets are assets used in business operations but which: a. b.. c. d. 3. lack physical substance (their value is in the rights and privileges they grant) cannot be sold have been depreciated below salvage value are usually current assets With respect to depreciation policies, the principle of consistency means: a. b. P c. d. a company should use the same depreciation methods in its financial statement that it uses in its income tax returns. a company should use the same depreciation methods as other companies in the same industry a company should use the same depreciation method from year to year for a particular plant asset. a company should change depreciation methods from year to year. If the preferred stock of a corporation is cumulative: 4. a. b. C. 5. d. dividends on preferred stock are guaranteed. dividends cannot be declared in an amount less than stated on the stock certificate.. preferred stockholders participate in dividends paid in excess of a stated amount on the common shares. dividends in arrears must be paid on preferred stock before any dividend can be paid on common stock. Retained earnings represents: b. C. d. cash collected from the sale of preferred stock. the amount initially invested in the business by stockholders. cash remaining from a bond issue. income which has been reinvested in the business rather than distributed as dividends to stockholders. When a corporation issues common stock at a price higher than the par value: the amount received over par value increases retained earnings 6. a. b. C. d. the entire issue price is credited to the Capital Stock account the amount received in excess of par value constitutes profit to the issuing corporation the amount received in excess of par value becomes part of additional paid-in capital. (APIC) For financial reporting purposes, the gain or loss on the sale of a depreciable long-term asset is determined by comparing the: cost to its book value.. 7. PUGL A. b. cash received to its book value. tax basis to its book value. d cash received to its tax basis.

Step by Step Solution

There are 3 Steps involved in it

Answer 1 c recognizes more depreciation expense in the early ye... View full answer

Get step-by-step solutions from verified subject matter experts