Question: An analyst has collected data about Devers Co. and a world market index. The world market index implies an equity risk premium of 5 percent,

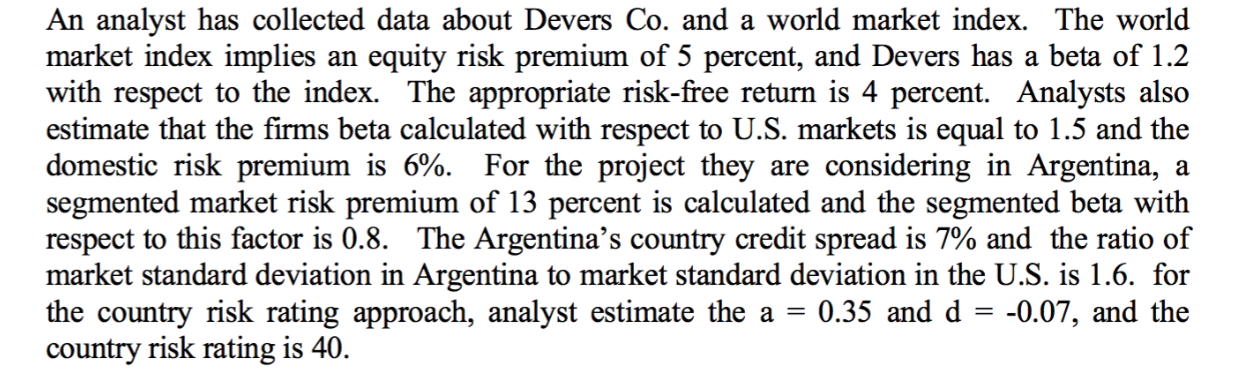

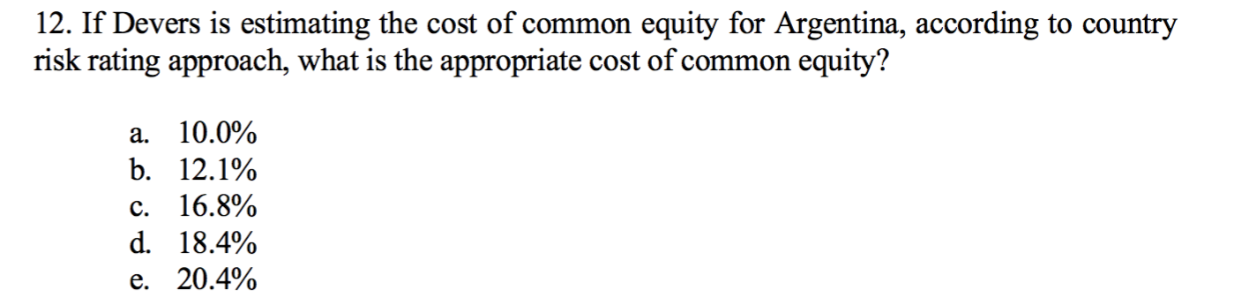

An analyst has collected data about Devers Co. and a world market index. The world market index implies an equity risk premium of 5 percent, and Devers has a beta of 1.2 with respect to the index. The appropriate risk-free return is 4 percent. Analysts also estimate that the firms beta calculated with respect to U.S. markets is equal to 1.5 and the domestic risk premium is 6%. For the project they are considering in Argentina, a segmented market risk premium of 13 percent is calculated and the segmented beta with respect to this factor is 0.8. The Argentina's country credit spread is 7% and the ratio of market standard deviation in Argentina to market standard deviation in the U.S. is 1.6. for the country risk rating approach, analyst estimate the a = 0.35 and d -0.07, and the country risk rating is 40. = 12. If Devers is estimating the cost of common equity for Argentina, according to country risk rating approach, what is the appropriate cost of common equity? a. 10.0% b. 12.1% c. 16.8% d. 18.4% e. 20.4% An analyst has collected data about Devers Co. and a world market index. The world market index implies an equity risk premium of 5 percent, and Devers has a beta of 1.2 with respect to the index. The appropriate risk-free return is 4 percent. Analysts also estimate that the firms beta calculated with respect to U.S. markets is equal to 1.5 and the domestic risk premium is 6%. For the project they are considering in Argentina, a segmented market risk premium of 13 percent is calculated and the segmented beta with respect to this factor is 0.8. The Argentina's country credit spread is 7% and the ratio of market standard deviation in Argentina to market standard deviation in the U.S. is 1.6. for the country risk rating approach, analyst estimate the a = 0.35 and d -0.07, and the country risk rating is 40. = 12. If Devers is estimating the cost of common equity for Argentina, according to country risk rating approach, what is the appropriate cost of common equity? a. 10.0% b. 12.1% c. 16.8% d. 18.4% e. 20.4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts