Question: 3. (8 points) An analyst has collected data about Conyers Inc. and a world market index. Analysts estimate that the firms beta calculated with

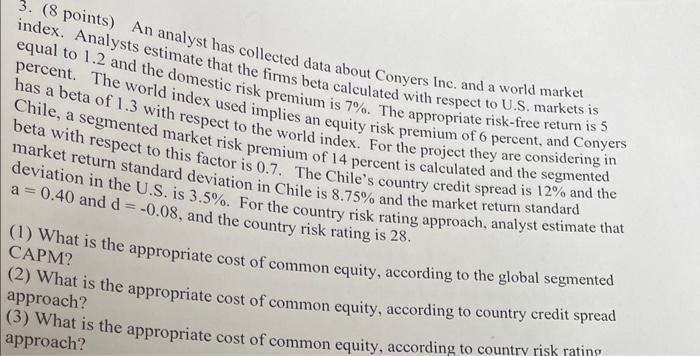

3. (8 points) An analyst has collected data about Conyers Inc. and a world market index. Analysts estimate that the firms beta calculated with respect to U.S. markets is equal to 1.2 and the domestic risk premium is 7%. The appropriate risk-free return is 5 percent. The world index used implies an equity risk premium of 6 percent, and Conyers has a beta of 1.3 with respect to the world index. For the project they are considering in Chile, a segmented market risk premium of 14 percent is calculated and the segmented beta with respect to this factor is 0.7. The Chile's country credit spread is 12% and the market return standard deviation in Chile is 8.75% and the market return standard deviation in the U.S. is 3.5%. For the country risk rating approach, analyst estimate that a = 0.40 and d = -0.08, and the country risk rating is 28. (1) What is the appropriate cost of common equity, according to the global segmented CAPM? (2) What is the appropriate cost of common equity, according to country credit spread approach? (3) What is the appropriate cost of common equity, according to country risk rating approach?

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

1 The appropriate cost of common equity according to the global segmented CAPM can be calculated as follows First we need to calculate the equity risk ... View full answer

Get step-by-step solutions from verified subject matter experts