Question: An analyst has completed a random sample of sell-side analyst recommendations and calculates the excess return (alpha) relative to the market for each sampled recommendation.

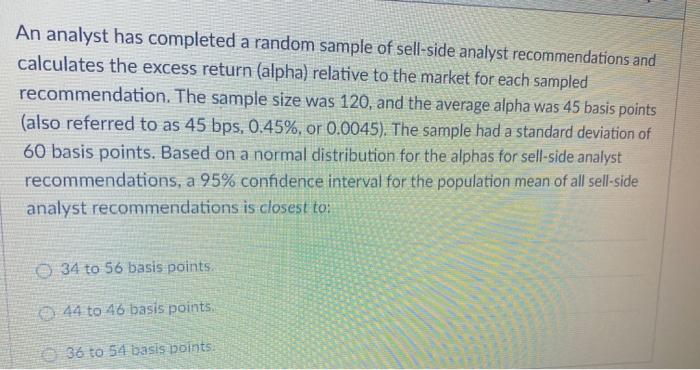

An analyst has completed a random sample of sell-side analyst recommendations and calculates the excess return (alpha) relative to the market for each sampled recommendation. The sample size was 120, and the average alpha was 45 basis points (also referred to as 45 bps, 0.45%, or 0.0045). The sample had a standard deviation of 60 basis points. Based on a normal distribution for the alphas for sell-side analyst recommendations, a 95% confidence interval for the population mean of all sell-side analyst recommendations is closest to: 34 to 56 basis points. , 44 to 46 basis points. 36 to 54 basis points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts