Question: An analyst is analyzing the last three years' balance sheets of Cosmo Inc. given in the following table. What will be the value of short-term

An analyst is analyzing the last three years' balance sheets of Cosmo Inc. given in the following table. What will be the value of short-term liabilities for the most recent year if an analyst converts the balance sheet into a vertical common-size balance sheet?

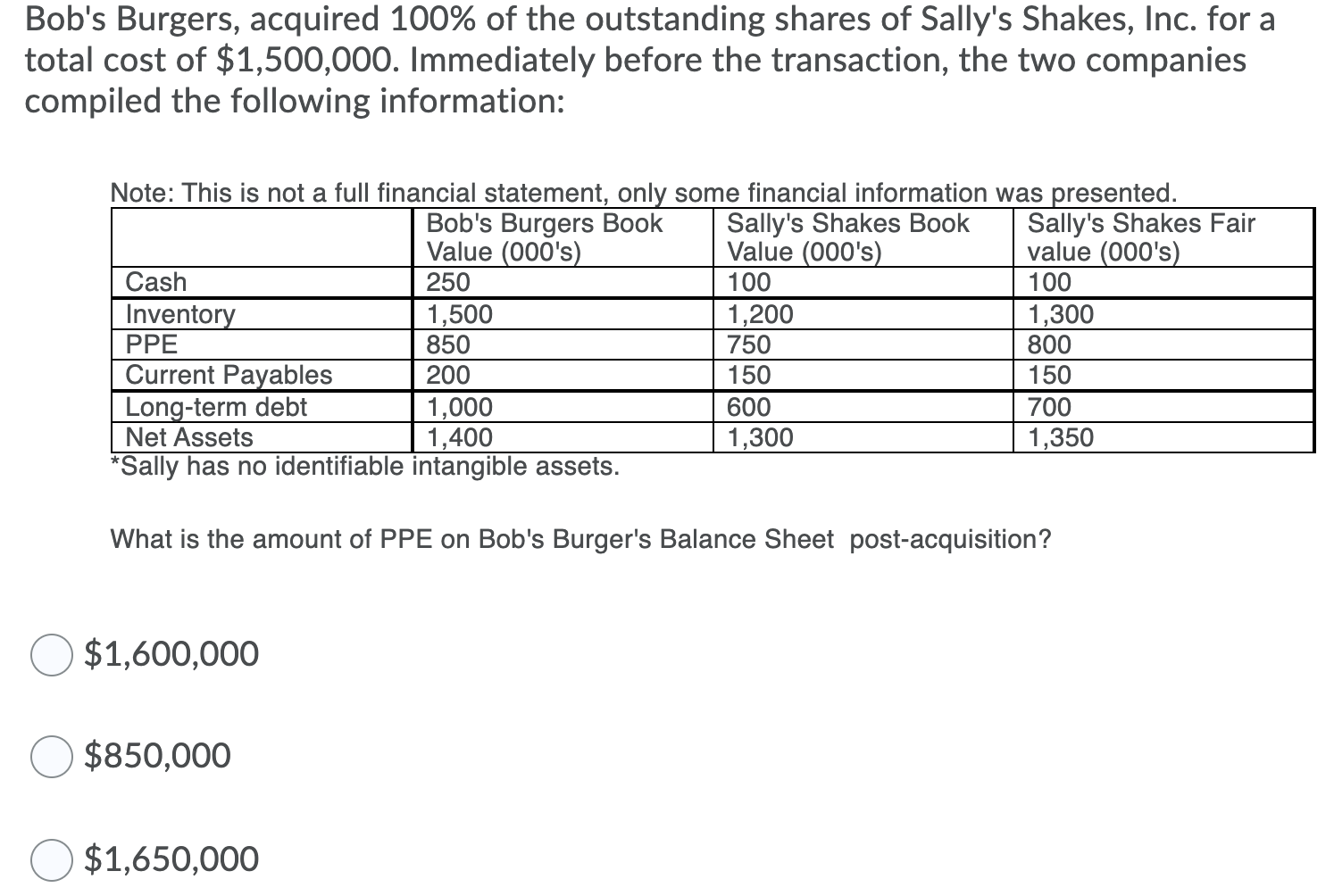

Bob's Burgers, acquired 100% of the outstanding shares of Sally's Shakes, Inc. for a total cost of $1,500,000. Immediately before the transaction, the two companies compiled the following information: Note: This is not a full financial statement, only some financial information was presented. Bob's Burgers Book Sally's Shakes Book Sally's Shakes Fair Value (000's) Value (000's) value (000's) Cash 250 100 100 Inventory 1,500 1,200 1,300 PPE 850 750 800 Current Payables 200 150 150 Long-term debt 1,000 600 700 Net Assets 1,400 1,300 1,350 *Sally has no identifiable intangible assets. What is the amount of PPE on Bob's Burger's Balance Sheet post-acquisition? O$ $1,600,000 $850,000 $1,650,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts