Question: An analyst is evaluating a company based on the information below: Equity beta = 1.3, risk-free rate = 2%, equity risk premium = 7.0% Cost

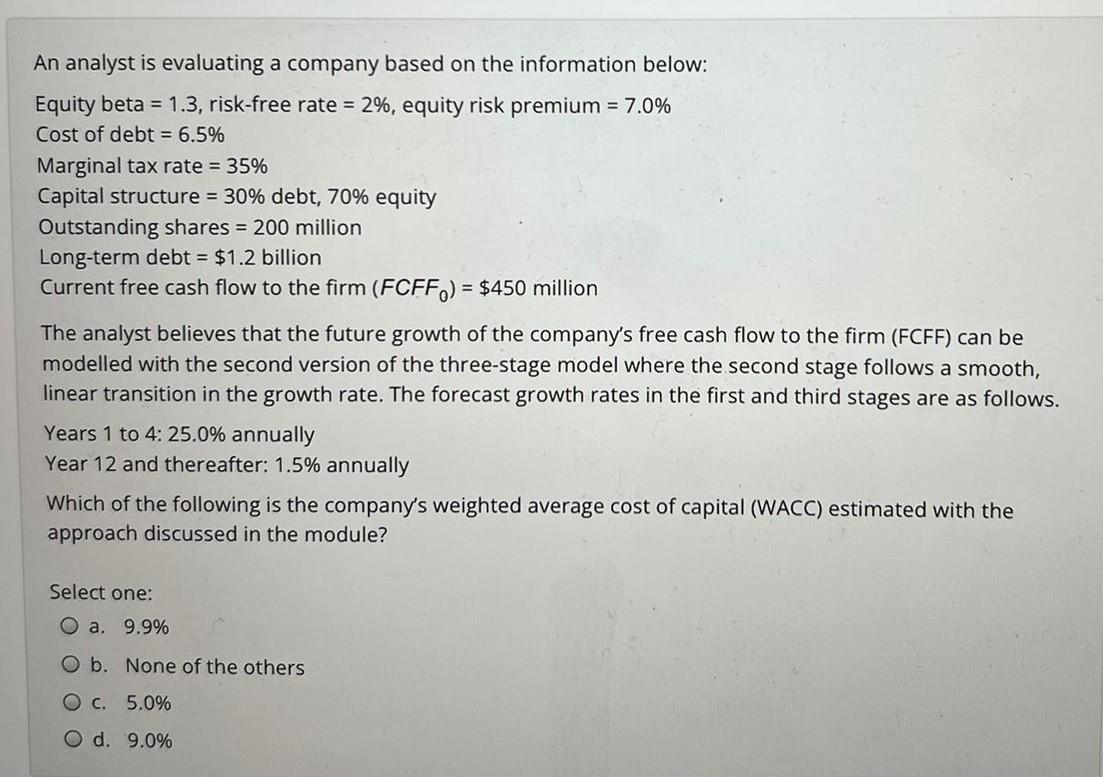

An analyst is evaluating a company based on the information below: Equity beta = 1.3, risk-free rate = 2%, equity risk premium = 7.0% Cost of debt = 6.5% Marginal tax rate = 35% Capital structure = 30% debt, 70% equity Outstanding shares = 200 million Long-term debt = $1.2 billion Current free cash flow to the firm (FCFF) = $450 million The analyst believes that the future growth of the company's free cash flow to the firm (FCFF) can be modelled with the second version of the three-stage model where the second stage follows a smooth, linear transition in the growth rate. The forecast growth rates in the first and third stages are as follows. Years 1 to 4: 25.0% annually Year 12 and thereafter: 1.5% annually Which of the following is the company's weighted average cost of capital (WACC) estimated with the approach discussed in the module? Select one: O a. 9.9% O b. None of the others O c. 5.0% O d. 9.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts