Question: An analyst is evaluating a planned 3-year corporate project. The project's cash flows in one of three possible scenarios (beginning in Year 0) are as

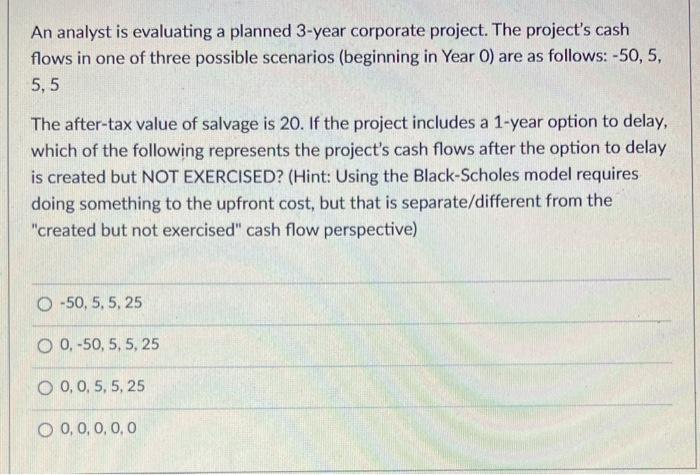

An analyst is evaluating a planned 3-year corporate project. The project's cash flows in one of three possible scenarios (beginning in Year 0) are as follows: -50, 5, 5,5 The after-tax value of salvage is 20 . If the project includes a 1 -year option to delay, which of the following represents the project's cash flows after the option to delay is created but NOT EXERCISED? (Hint: Using the Black-Scholes model requires doing something to the upfront cost, but that is separate/different from the "created but not exercised" cash flow perspective) 50,5,5,250,50,5,5,250,0,5,5,250,0,0,0,0

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock