Question: An analyst is evaluating two projects. Project A has projected cash flows of $7,500, $6,000, and $4,500 for the next three years, respectively. Project

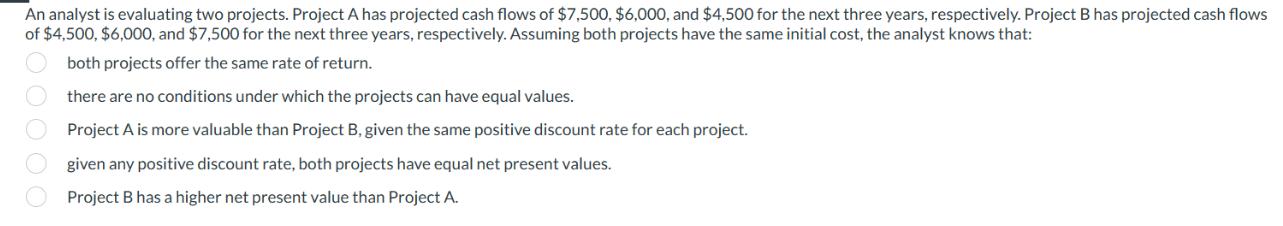

An analyst is evaluating two projects. Project A has projected cash flows of $7,500, $6,000, and $4,500 for the next three years, respectively. Project B has projected cash flows of $4,500, $6,000, and $7,500 for the next three years, respectively. Assuming both projects have the same initial cost, the analyst knows that: 500000 both projects offer the same rate of return. there are no conditions under which the projects can have equal values. Project A is more valuable than Project B, given the same positive discount rate for each project. given any positive discount rate, both projects have equal net present values. Project B has a higher net present value than Project A.

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below The co... View full answer

Get step-by-step solutions from verified subject matter experts