Question: An analyst is interested in assessing both the efficiency and liquidity of Revlon Inc. The analyst has collected the following data for Revlon: a. Is

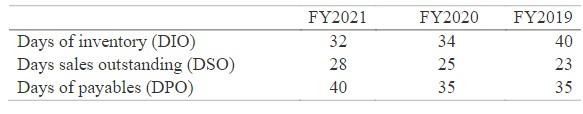

An analyst is interested in assessing both the efficiency and liquidity of Revlon Inc. The analyst has collected the following data for Revlon:

a. Is Revlon utilizing its current assets and liabilities efficiently? Explain. Use the cash conversion cycle to answer the question. b. What do you think are the reasons for the change in Revlons efficiency?

\begin{tabular}{lccr} \hline & FY2021 & FY2020 & FY2019 \\ \hline Days of inventory (DIO) & 32 & 34 & 40 \\ Days sales outstanding (DSO) & 28 & 25 & 23 \\ Days of payables (DPO) & 40 & 35 & 35 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts