Question: An analyst is trying to value a loss-making but high growth firm using a DCF model based on 'percent of sales' forecast financial statements with

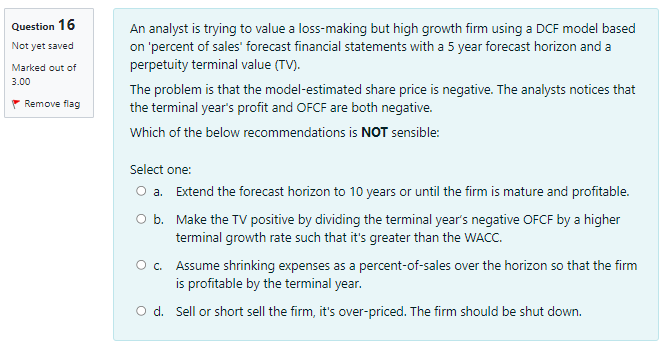

An analyst is trying to value a loss-making but high growth firm using a DCF model based on 'percent of sales' forecast financial statements with a 5 year forecast horizon and a perpetuity terminal value (TV). The problem is that the model-estimated share price is negative. The analysts notices that the terminal year's profit and OFCF are both negative. Which of the below recommendations is NOT sensible: Select one: a. Extend the forecast horizon to 10 years or until the firm is mature and profitable. b. Make the TV positive by dividing the terminal year's negative OFCF by a higher terminal growth rate such that it's greater than the WACC. c. Assume shrinking expenses as a percent-of-sales over the horizon so that the firm is profitable by the terminal year. d. Sell or short sell the firm, it's over-priced. The firm should be shut down

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts