Question: An analyst is using a two-state continuous-time model to study the credit risk of zero- coupon bonds issued by different companies. The risk-neutral transition

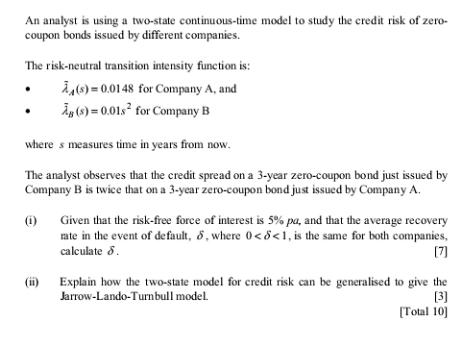

An analyst is using a two-state continuous-time model to study the credit risk of zero- coupon bonds issued by different companies. The risk-neutral transition intensity function is: (s) = 0.0148 for Company A, and A (s) = 0.01s for Company B where s measures time in years from now. The analyst observes that the credit spread on a 3-year zero-coupon bond just issued by Company B is twice that on a 3-year zero-coupon bond just issued by Company A. (1) Given that the risk-free force of interest is 5% pa, and that the average recovery rate in the event of default, 8, where 0

Step by Step Solution

There are 3 Steps involved in it

The images contain two separate questions concerning risk analysis and transition probabilities Lets address each question individually Starting with the first question about the credit risk of zeroco... View full answer

Get step-by-step solutions from verified subject matter experts