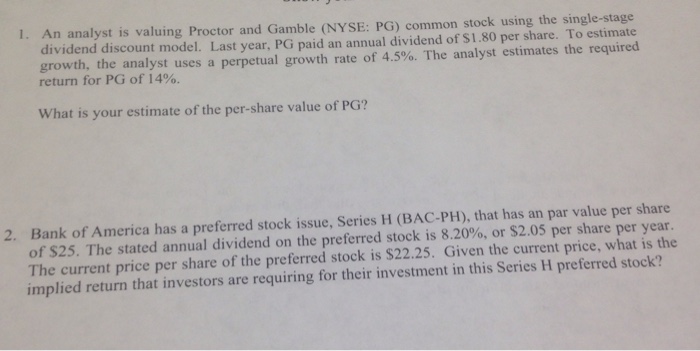

Question: An analyst is valuing Proctor and Gamble (NYSE: PG) common stock using the single-stage divided discount model. Last year, PG paid an annual dividend of

An analyst is valuing Proctor and Gamble (NYSE: PG) common stock using the single-stage divided discount model. Last year, PG paid an annual dividend of $1.80 per share. To estimate growth, the analyst uses a perpetual growth rate of 4.5%. The analyst estimates the required return for PG of 14%. What is your estimate of the per-share value of PG? Bank of America has a preferred stock issue, Series H (BAC-PH), that has an par value per share of $25. The stated annual dividend on the preferred stock is 8.20%, or $2.05 per share per year. The current price per share of the preferred stock is $22.25. Given the current price, what is the implied return that investors are requiring for their investment in this Series H preferred stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts