Question: An analyst performs a five year forecast for the annual total return, annualized stondard deviation of retuns, and market risk for the S&P500 and for

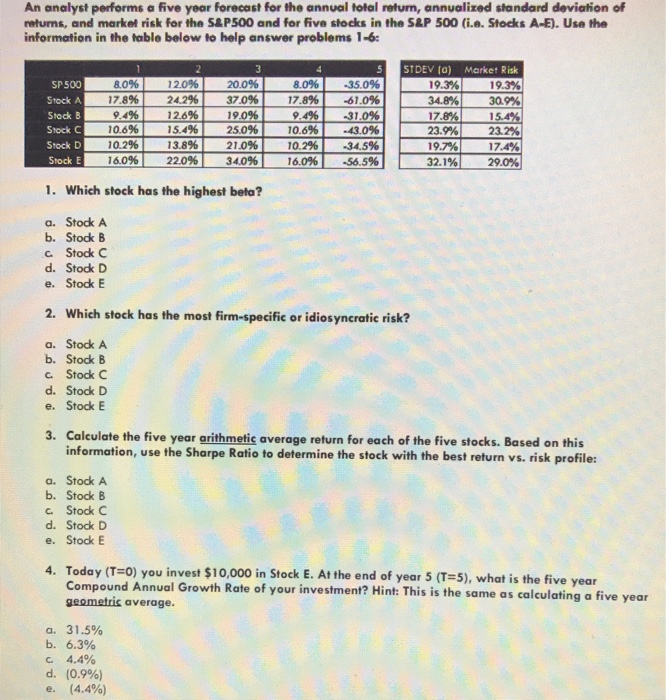

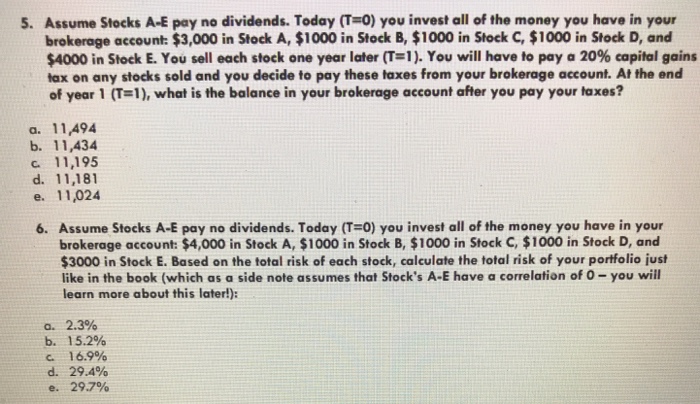

An analyst performs a five year forecast for the annual total return, annualized stondard deviation of retuns, and market risk for the S&P500 and for five stocks in the S&P 500 (i.e. Stoeks A-E). Use the information in the table below to help answer problems 1-6 STDEV (o) Market Risk 19.3% 30.9% SP500 Stock A Stock B Stock C Stock D Stock E 12.0% 24.2% | 12.69 15.4% 13.8% 22.0% | 8.0% -35.0% 17.8% | -61.0% 9.4961-31.0% 10 69 "43.0% 10.2% -34.5% 16.0% -56.5% 19.3% 34.8%| 17 23.9% 19.7% 32.1%| 8.096 | 17.8% | 9.496| 20.0% 37.0%) 19.09 10.2% 16.0% | 21.0% 34.0% | 23.2% 17.4% 29.0% 1. Which stock has the highest beta? a. Stock A b. Stock B c Stock C d. Stock D e. Stock E 2. Which stock has the most firm-specific or idiosyncratic risk? a. Stock A b. Stock B c. Stock C d. Stock D e. Stock E 3. Caleulate the five year arithmetic average return for each of the five stocks. Based on this information, use the Sharpe Ratio to determine the stock with the best return vs. risk profile: a. Stock A b. StockB c. Stock C d. Stock D e. StockE 4. Today (T=0) you invest $10,000 in Stock E. At the end of year 5 (T-5), what is the five year Compound Annual Growth Rate of your investment? Hint: This is the same as calculating a fi geometris average. ve year a. 31.5% b. 6.3% c 4.4% d. (0.9%) e. (4.4%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts