Question: An analyst predicted that Logistics, Inc. stock, would offer a total return of at least 12% in the coming yeur. At the beginning of the

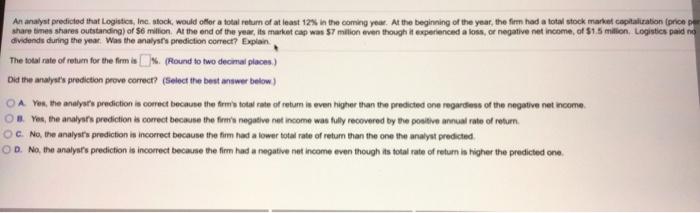

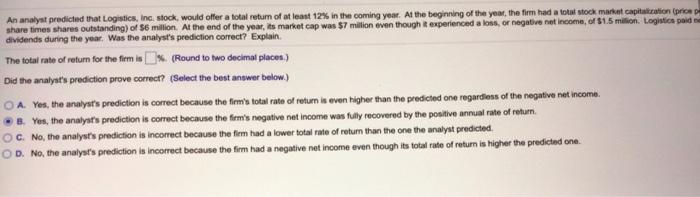

An analyst predicted that Logistics, Inc. stock, would offer a total return of at least 12% in the coming yeur. At the beginning of the year, the firm had a total stock market capitalization (price share times stores outstanding) or $6 million. At the end of the year, its market cap was $7 milion even though it experienced a loss, or negative net income of $1.5 million Logistics pad ng dividends during the year. Was the analys's prediction correct? Explain The total rate of rotum for the firm in I. (Round to two decimal places) Did the answyer's prediction prove correct? (Select the best answer below) OA YR, the analysts prediction is correct because the free to rate of retum is even higher than the predicted one regardless of the negative net income OB Yes, the analysts prediction is correct because the firm negative net income was ally recovered by the positive annual rate of return OC. No, the analysts prediction is incorrect because the firm had a lower total rate of return than the one the analyst predicted OD. No, the analyut's prediction is incorrect because the firm had a negative net income even though is total rate of retum in higher the predicted one An analyst predicted that Logistics, Inc. stock, would offer a total return of at least 12% in the coming year. At the beginning of the year, the firm had a total stock market capitalization price share times shares outstanding) of $6 million. At the end of the year, its market cap was $7 million even though experienced a loss, or negative net income, of 1.5 million. Logistics paid dividends during the year. Was the analyst's prediction correct? Explain The total rate of return for the firm is % (Round to two decimal places) Did the analyst's prediction prove correct? (Select the best answer below.) OA. Yes, the analyst's prediction is correct because the firm's total rate of return is even higher than the predicted one regardless of the negative net income. B. Yes, the analyst's prediction is correct because the firm's negative net income was fully recovered by the positive annual rate of return OC. No, the analyst's prediction is incorrect because the firm had a lower total rate of return than the one the analyst predicted OD. No, the analyst's prediction is incorrect because the firm had a negative net income even though its total rate of return is higher the predicted one

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts