Question: An analyst uses the classic Sharpe's method to do a returns-based style analysis for a long-short portfolio using market, momentum, and size factors. He found

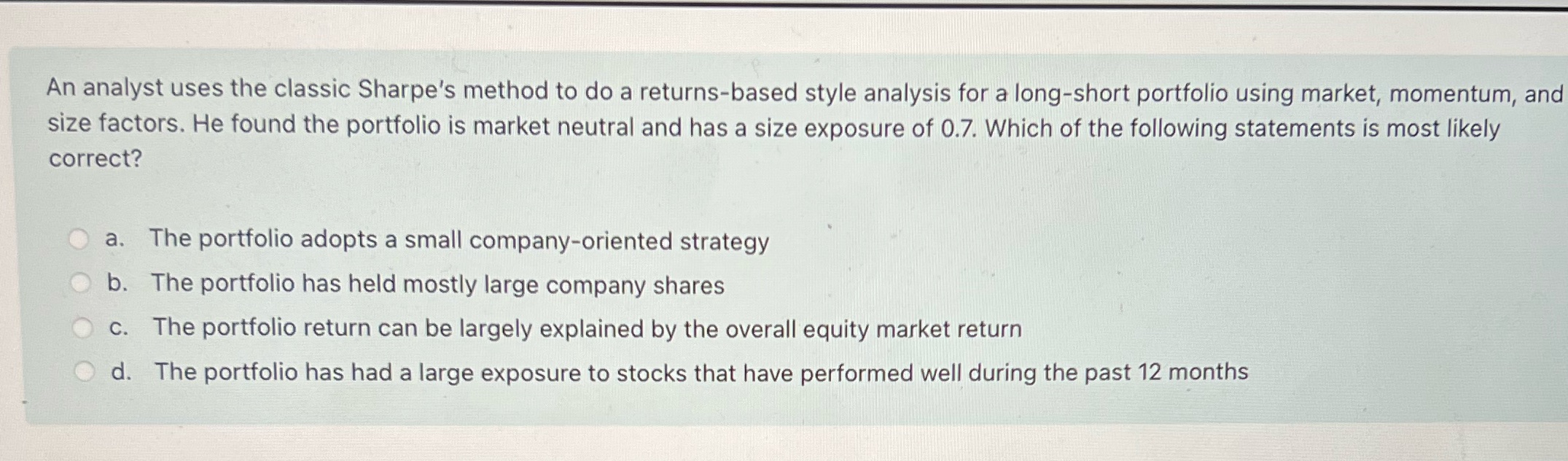

An analyst uses the classic Sharpe's method to do a returns-based style analysis for a long-short portfolio using market, momentum, and size factors. He found the portfolio is market neutral and has a size exposure of 0.7. Which of the following statements is most likely correct? a. The portfolio adopts a small company-oriented strategy b. The portfolio has held mostly large company shares O c. The portfolio return can be largely explained by the overall equity market return O d. The portfolio has had a large exposure to stocks that have performed well during the past 12 months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts