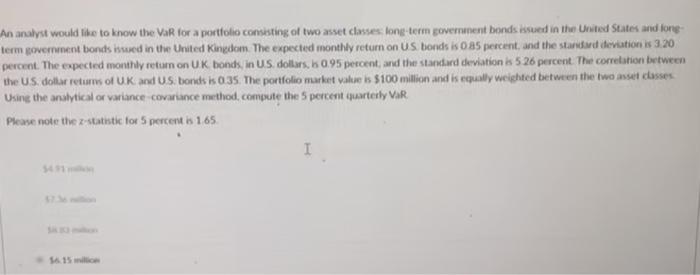

Question: An analyst would like to know the VaR for a portfolio consisting of two asset classes long-term government bonds issued in the United States and

An analyst would like to know the VaR for a portfolio consisting of two asset classes long-term government bonds issued in the United States and fong- term government bonds issued in the United Kingdom. The expected monthly return on US bonds is o as percent, and the standard deviation is 3.20 percent. The expected monthly return on UK bonds, in US dollars, 0.95 percent and the standard deviation is 5 26 percent. The correlation between the US dollar returns of UK and US bonds is 0.35. The portfolio market value is $100 million and is equally weighted between the two asset classes Using the analytical or variance covariance method, compute the 5 percent quarterly VaR. Please note the z-statistic for 5 percent nt is 165 I 16.15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts