Question: An analyst would like to know the VaR for a portfolio consisting of two asset classes: long-term government bonds issued in the United States and

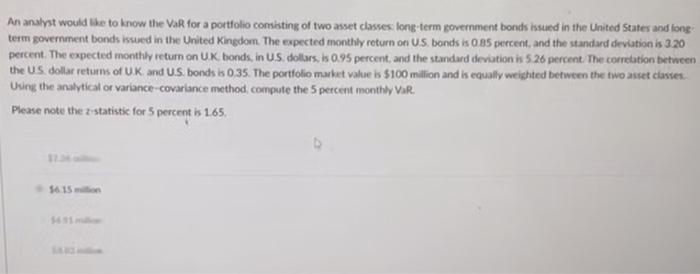

An analyst would like to know the VaR for a portfolio consisting of two asset classes: long-term government bonds issued in the United States and long term government bonds issued in the United Kingdom. The expected monthly return on U.S. bonds is 0.85 percent, and the standard deviation is 3 20 percent. The expected monthly return on UK bonds, in US dollars, is 0.95 percent, and the standard deviation is 5 26 percent. The correlation between the US dollar returns of UK and U.S. bonds is 0.35. The portfolio market value is $100 million and is equally weighted between the two asset classes Using the analytical or variance covariance method, compute the 5 percent monthly VaR. Please note the statistic for 5 percent is 1.65 5615

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts