Question: An asset cannot be depreciated below its estimated salvage value. Only the straight line method works out mathematically to prevent this from happening. When using

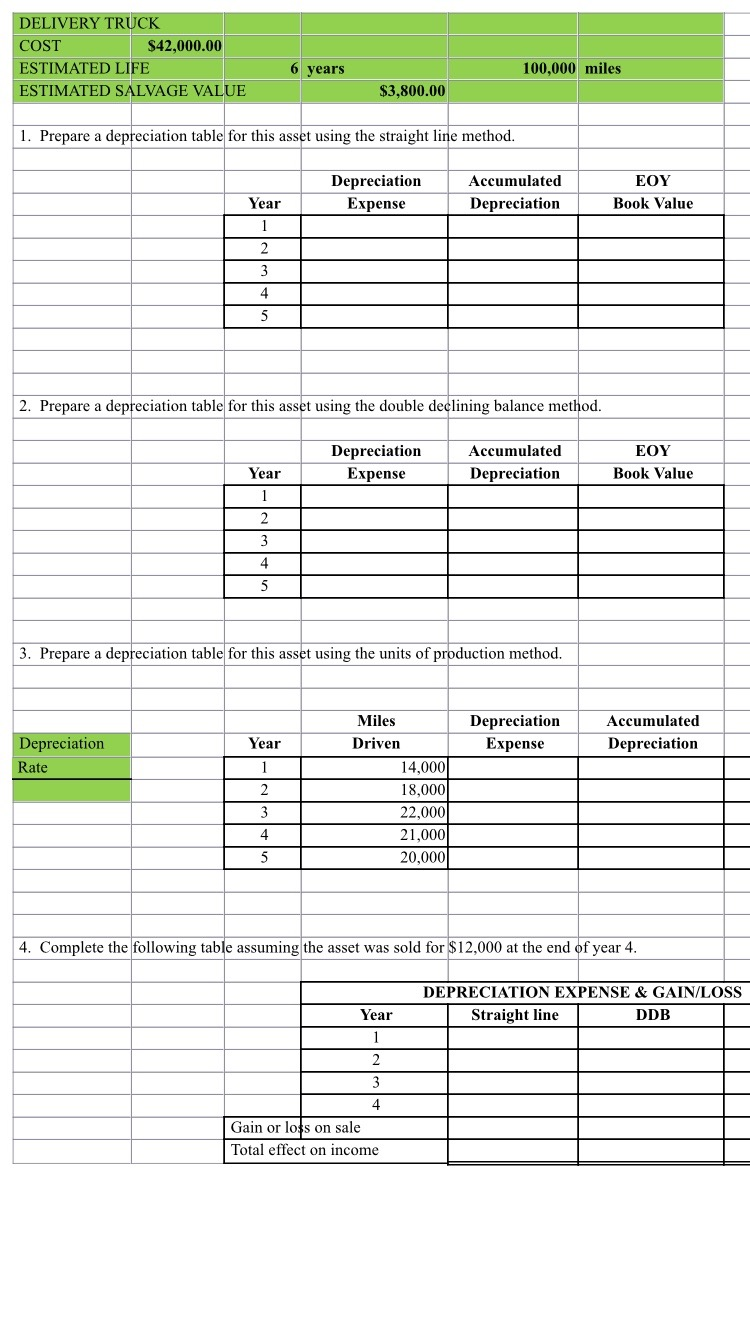

An asset cannot be depreciated below its estimated salvage value. Only the straight line method works out mathematically to prevent this from happening. When using the other two methods, if the formula calculates a depreciation expense that causes the remaining book value to fall below salvage value (usually in the final year), the formula is abandoned, and the depreciation expense for the period is the difference between the book value at the beginning of the year and the estimated salvage value. For example, if the beginning BV is $20,000 and the estimated SV is $18,000, the highest the depreciation expense can be is $2,000, regardless of what the formula calculates. Likewise, if using the formula in the final year of the asset's life does not calculate enough depreciation  expense to bring the remaining BV down to the estimated SV, use the amount calculated by the formula for that year.

expense to bring the remaining BV down to the estimated SV, use the amount calculated by the formula for that year.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts