Question: An asset falls into a CCA class which has a maximum CCA rate of 23%. The cost of the asset was $205,200. The firm's

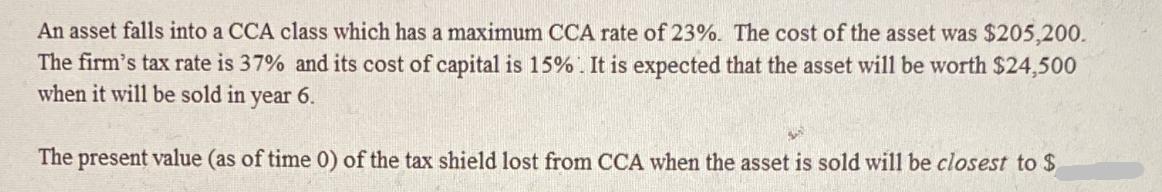

An asset falls into a CCA class which has a maximum CCA rate of 23%. The cost of the asset was $205,200. The firm's tax rate is 37% and its cost of capital is 15%. It is expected that the asset will be worth $24,500 when it will be sold in year 6. The present value (as of time 0) of the tax shield lost from CCA when the asset is sold will be closest to $

Step by Step Solution

There are 3 Steps involved in it

To calculate the present value of the tax shield lost from CCA when the asset is sold we need to find the tax shield for each year and then discount t... View full answer

Get step-by-step solutions from verified subject matter experts