Question: An engineer is choosing between three different alternatives for a machine component he needs to complete his biorefinery. He summarized the pertinent information about these

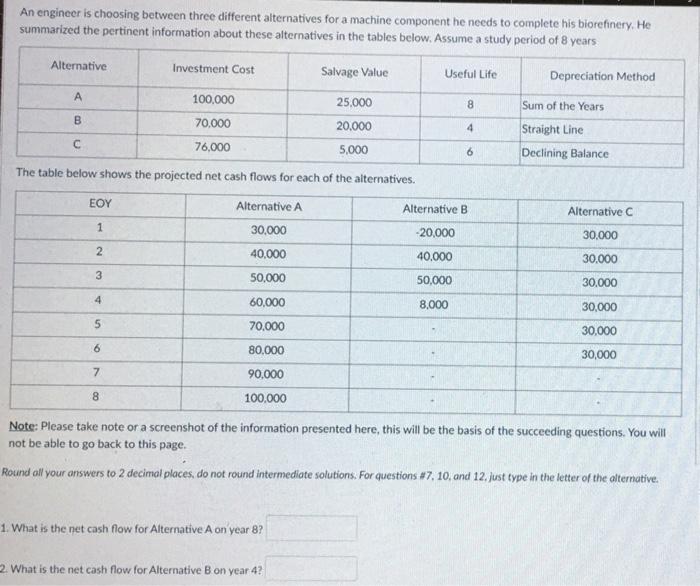

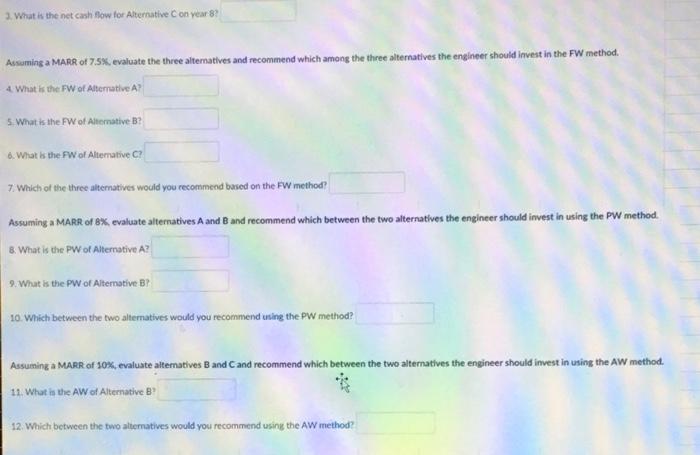

An engineer is choosing between three different alternatives for a machine component he needs to complete his biorefinery. He summarized the pertinent information about these alternatives in the tables below. Assume a study period of 8 years Ine tabie below shows the projected net cash flows for each of the alternatives. Note: Please take note or a screenshot of the information presented here, this will be the basis of the succeeding questions. You will not be able to go back to this page. Round all your answers to 2 decimal places, do not round intermediate solutions. For questions #7,10, and 12, just type in the letter of the alternative. What is the net cash flow for Alternative A on year 8 ? What is the net cash flow for Alternative B on year 4 ? Aswaming a MARR of 7.5\%, evaluate the three altematives and recommend which among the three alternatives the engineer should invest in the FW method. 4. What is the FW of Alternative A? 5. What is the FW of Atconative B? 6. What 6 the FW of Alternative C? 7. Which of the three altematives would you cecommend based on the FW method? Assuming a MARR of B%, evaluate alternatives A and B and recommend which between the two alternatives the engineer should invest in using the PW method. 8. What is the PWo Alternative A? 9. What is the PW of Aternstive B? 10. Which between the two altematives would you recommend using the PW method? Assuming a MARR of 10x, evaluate altematives B and C and recommend which between the two altematives the engineer should invest in using the AW method. 11. What is the AW of Alternative B3 12. Which between the two atternatives would you recommend using the AW method? An engineer is choosing between three different alternatives for a machine component he needs to complete his biorefinery. He summarized the pertinent information about these alternatives in the tables below. Assume a study period of 8 years Ine tabie below shows the projected net cash flows for each of the alternatives. Note: Please take note or a screenshot of the information presented here, this will be the basis of the succeeding questions. You will not be able to go back to this page. Round all your answers to 2 decimal places, do not round intermediate solutions. For questions #7,10, and 12, just type in the letter of the alternative. What is the net cash flow for Alternative A on year 8 ? What is the net cash flow for Alternative B on year 4 ? Aswaming a MARR of 7.5\%, evaluate the three altematives and recommend which among the three alternatives the engineer should invest in the FW method. 4. What is the FW of Alternative A? 5. What is the FW of Atconative B? 6. What 6 the FW of Alternative C? 7. Which of the three altematives would you cecommend based on the FW method? Assuming a MARR of B%, evaluate alternatives A and B and recommend which between the two alternatives the engineer should invest in using the PW method. 8. What is the PWo Alternative A? 9. What is the PW of Aternstive B? 10. Which between the two altematives would you recommend using the PW method? Assuming a MARR of 10x, evaluate altematives B and C and recommend which between the two altematives the engineer should invest in using the AW method. 11. What is the AW of Alternative B3 12. Which between the two atternatives would you recommend using the AW method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts