Question: An engineering company needs to decide whether or not to build a new factory. The costs of building the factory are $150 million initially,

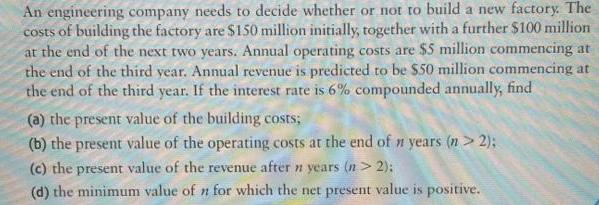

An engineering company needs to decide whether or not to build a new factory. The costs of building the factory are $150 million initially, together with a further $100 million at the end of the next two years. Annual operating costs are $5 million commencing at the end of the third year. Annual revenue is predicted to be $50 million commencing at the end of the third year. If the interest rate is 6% compounded annually, find (a) the present value of the building costs; (b) the present value of the operating costs at the end of n years (n> 2); (c) the present value of the revenue after n years (n> 2): (d) the minimum value of n for which the net present value is positive. An engineering company needs to decide whether or not to build a new factory. The costs of building the factory are $150 million initially, together with a further $100 million at the end of the next two years. Annual operating costs are $5 million commencing at the end of the third year. Annual revenue is predicted to be $50 million commencing at the end of the third year. If the interest rate is 6% compounded annually, find (a) the present value of the building costs; (b) the present value of the operating costs at the end of n years (n> 2); (c) the present value of the revenue after n years (n> 2): (d) the minimum value of n for which the net present value is positive.

Step by Step Solution

3.32 Rating (149 Votes )

There are 3 Steps involved in it

a PV of the building costs 150 100 106 100 106 2 33334 milli... View full answer

Get step-by-step solutions from verified subject matter experts