Question: An engineering project analyst is contemplating a 3-year project which will require an initial investment for equipment of $85,000. It is anticipated that, if

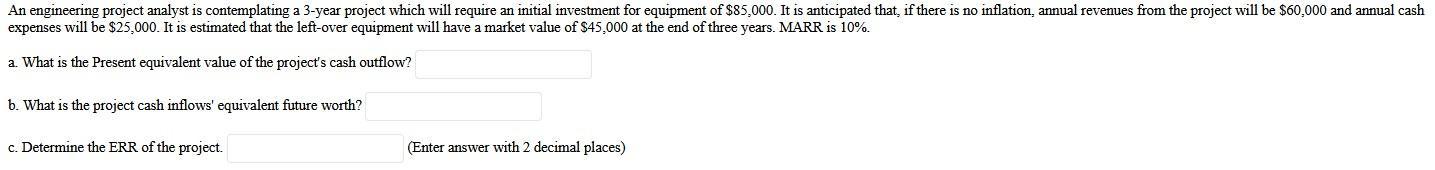

An engineering project analyst is contemplating a 3-year project which will require an initial investment for equipment of $85,000. It is anticipated that, if there is no inflation, annual revenues from the project will be $60,000 and annual cash expenses will be $25,000. It is estimated that the left-over equipment will have a market value of $45,000 at the end of three years. MARR is 10%. a. What is the Present equivalent value of the project's cash outflow? b. What is the project cash inflows' equivalent future worth? c. Determine the ERR of the project. (Enter answer with 2 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Project Cash Flow Analysis Given Initial Investment 85000 Annual Revenue 60000 Annual Cash Expense 2... View full answer

Get step-by-step solutions from verified subject matter experts