Question: An equity analyst has evaluated historical financial performance and risk analysis to perform a comprehensive valuation assessment for the intrinsic value of the stock for

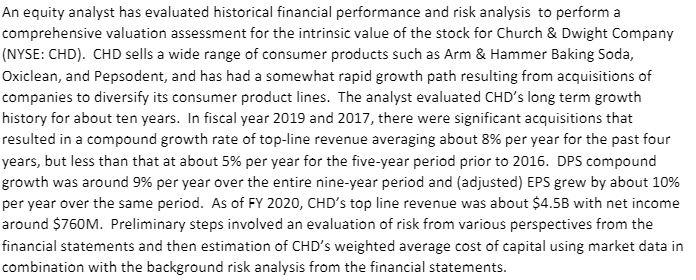

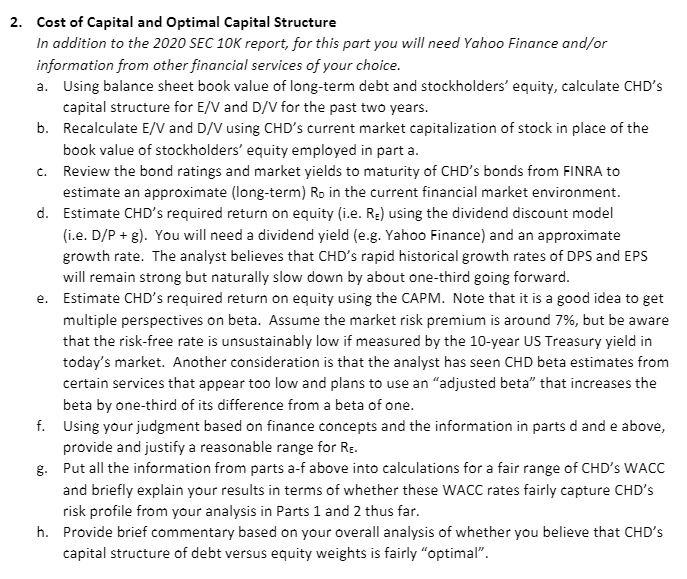

An equity analyst has evaluated historical financial performance and risk analysis to perform a comprehensive valuation assessment for the intrinsic value of the stock for Church & Dwight Company (NYSE: CHD). CHD sells a wide range of consumer products such as Arm & Hammer Baking Soda, Oxiclean, and Pepsodent, and has had a somewhat rapid growth path resulting from acquisitions of companies to diversify its consumer product lines. The analyst evaluated CHD's long term growth history for about ten years. In fiscal year 2019 and 2017, there were significant acquisitions that resulted in a compound growth rate of top-line revenue averaging about 8% per year for the past four years, but less than that at about 5% per year for the five-year period prior to 2016. DPS compound growth was around 9% per year over the entire nine-year period and (adjusted) EPS grew by about 10% per year over the same period. As of FY 2020, CHD's top line revenue was about $4.5B with net income around $760M. Preliminary steps involved an evaluation of risk from various perspectives from the financial statements and then estimation of CHD's weighted average cost of capital using market data in combination with the background risk analysis from the financial statements. 2. Cost of Capital and Optimal Capital Structure In addition to the 2020 SEC 10K report, for this part you will need Yahoo Finance and/or information from other financial services of your choice. a. Using balance sheet book value of long-term debt and stockholders' equity, calculate CHD's capital structure for E/V and D/V for the past two years. b. Recalculate E/V and D/V using CHD's current market capitalization of stock in place of the book value of stockholders' equity employed in part a. c. Review the bond ratings and market yields to maturity of CHD's bonds from FINRA to estimate an approximate (long-term) Ro in the current financial market environment. d. Estimate CHD's required return on equity (i.e. Re) using the dividend discount model (i.e. D/P + g). You will need a dividend yield (e.g. Yahoo Finance) and an approximate growth rate. The analyst believes that CHD's rapid historical growth rates of DPS and EPS will remain strong but naturally slow down by about one-third going forward. e. Estimate CHD's required return on equity using the CAPM. Note that it is a good idea to get multiple perspectives on beta. Assume the market risk premium is around 7%, but be aware that the risk-free rate is unsustainably low if measured by the 10-year US Treasury yield in today's market. Another consideration is that the analyst has seen CHD beta estimates from certain services that appear too low and plans to use an "adjusted beta" that increases the beta by one-third of its difference from a beta of one. f. Using your judgment based on finance concepts and the information in parts d and e above, provide and justify a reasonable range for Re. g. Put all the information from parts a-f above into calculations for a fair range of CHD's WACC and briefly explain your results in terms of whether these WACC rates fairly capture CHD's risk profile from your analysis in Parts 1 and 2 thus far. h. Provide brief commentary based on your overall analysis of whether you believe that CHD's capital structure of debt versus equity weights is fairly "optimal". An equity analyst has evaluated historical financial performance and risk analysis to perform a comprehensive valuation assessment for the intrinsic value of the stock for Church & Dwight Company (NYSE: CHD). CHD sells a wide range of consumer products such as Arm & Hammer Baking Soda, Oxiclean, and Pepsodent, and has had a somewhat rapid growth path resulting from acquisitions of companies to diversify its consumer product lines. The analyst evaluated CHD's long term growth history for about ten years. In fiscal year 2019 and 2017, there were significant acquisitions that resulted in a compound growth rate of top-line revenue averaging about 8% per year for the past four years, but less than that at about 5% per year for the five-year period prior to 2016. DPS compound growth was around 9% per year over the entire nine-year period and (adjusted) EPS grew by about 10% per year over the same period. As of FY 2020, CHD's top line revenue was about $4.5B with net income around $760M. Preliminary steps involved an evaluation of risk from various perspectives from the financial statements and then estimation of CHD's weighted average cost of capital using market data in combination with the background risk analysis from the financial statements. 2. Cost of Capital and Optimal Capital Structure In addition to the 2020 SEC 10K report, for this part you will need Yahoo Finance and/or information from other financial services of your choice. a. Using balance sheet book value of long-term debt and stockholders' equity, calculate CHD's capital structure for E/V and D/V for the past two years. b. Recalculate E/V and D/V using CHD's current market capitalization of stock in place of the book value of stockholders' equity employed in part a. c. Review the bond ratings and market yields to maturity of CHD's bonds from FINRA to estimate an approximate (long-term) Ro in the current financial market environment. d. Estimate CHD's required return on equity (i.e. Re) using the dividend discount model (i.e. D/P + g). You will need a dividend yield (e.g. Yahoo Finance) and an approximate growth rate. The analyst believes that CHD's rapid historical growth rates of DPS and EPS will remain strong but naturally slow down by about one-third going forward. e. Estimate CHD's required return on equity using the CAPM. Note that it is a good idea to get multiple perspectives on beta. Assume the market risk premium is around 7%, but be aware that the risk-free rate is unsustainably low if measured by the 10-year US Treasury yield in today's market. Another consideration is that the analyst has seen CHD beta estimates from certain services that appear too low and plans to use an "adjusted beta" that increases the beta by one-third of its difference from a beta of one. f. Using your judgment based on finance concepts and the information in parts d and e above, provide and justify a reasonable range for Re. g. Put all the information from parts a-f above into calculations for a fair range of CHD's WACC and briefly explain your results in terms of whether these WACC rates fairly capture CHD's risk profile from your analysis in Parts 1 and 2 thus far. h. Provide brief commentary based on your overall analysis of whether you believe that CHD's capital structure of debt versus equity weights is fairly "optimal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts