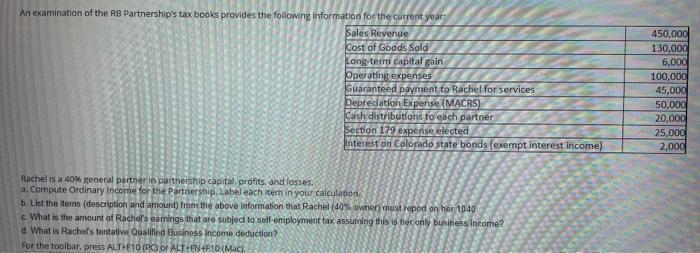

An examination of the RB Partnership's tax books provides the following information for the current year...

Fantastic news! We've Found the answer you've been seeking!

Question:

Related Book For

Income Tax Fundamentals 2013

ISBN: 9781285586618

31st Edition

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

Posted Date: