Question: An increase in commodity prices would increase the company's sales in USD terms, all else being equal. On the other hand, the appreciation of

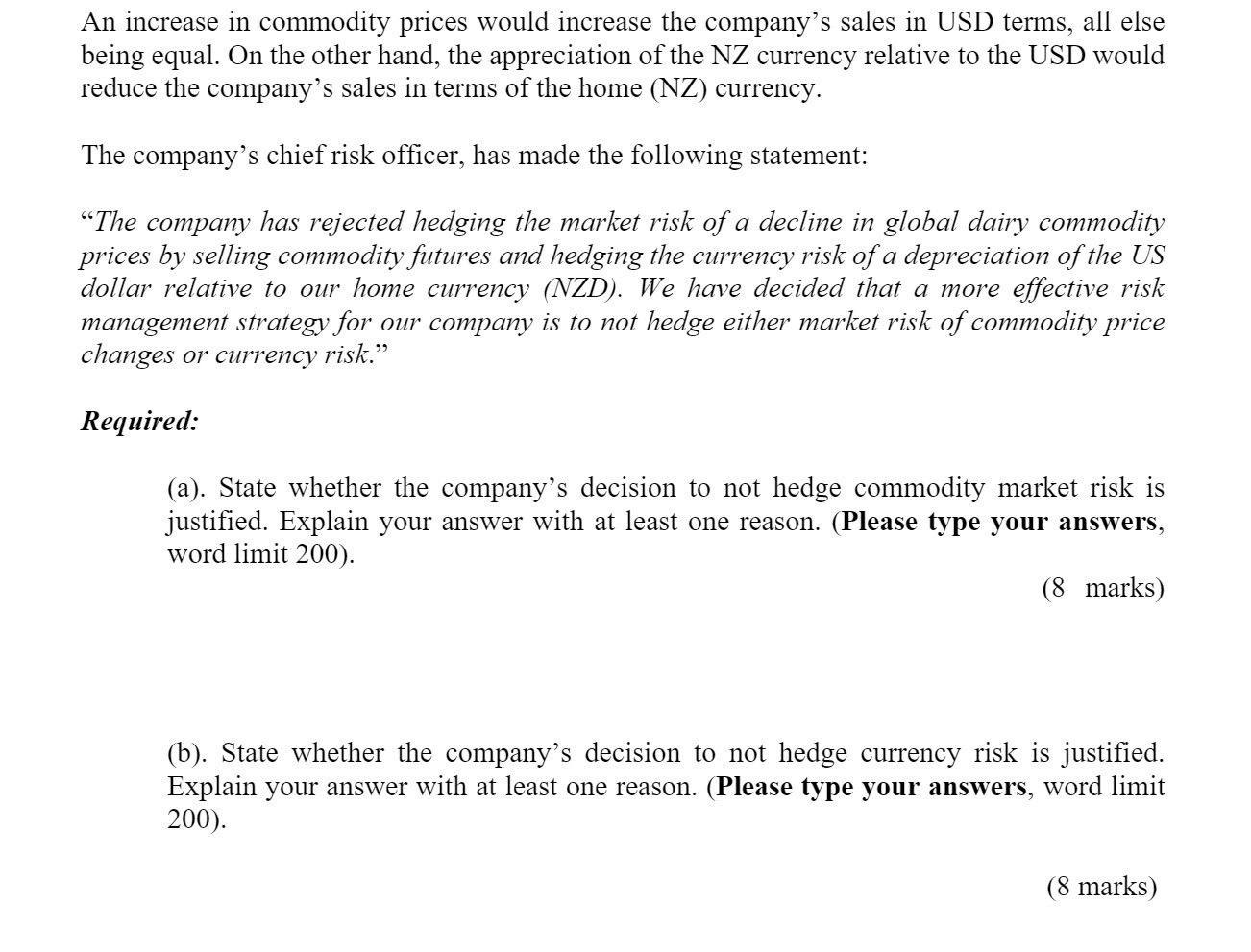

An increase in commodity prices would increase the company's sales in USD terms, all else being equal. On the other hand, the appreciation of the NZ currency relative to the USD would reduce the company's sales in terms of the home (NZ) currency. The company's chief risk officer, has made the following statement: "The company has rejected hedging the market risk of a decline in global dairy commodity prices by selling commodity futures and hedging the currency risk of a depreciation of the US dollar relative to our home currency (NZD). We have decided that a more effective risk management strategy for our company is to not hedge either market risk of commodity price changes or currency risk." Required: (a). State whether the company's decision to not hedge commodity market risk is justified. Explain your answer with at least one reason. (Please type your answers, word limit 200). (8 marks) (b). State whether the company's decision to not hedge currency risk is justified. Explain your answer with at least one reason. (Please type your answers, word limit 200). (8 marks)

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

a The companys decision to not hedge commodity market risk may be justified under certain circumstan... View full answer

Get step-by-step solutions from verified subject matter experts