Question: An investor plans to develop a regression model for the appraisal value (in thousands of dollars) of property in her city (Y) based on 5

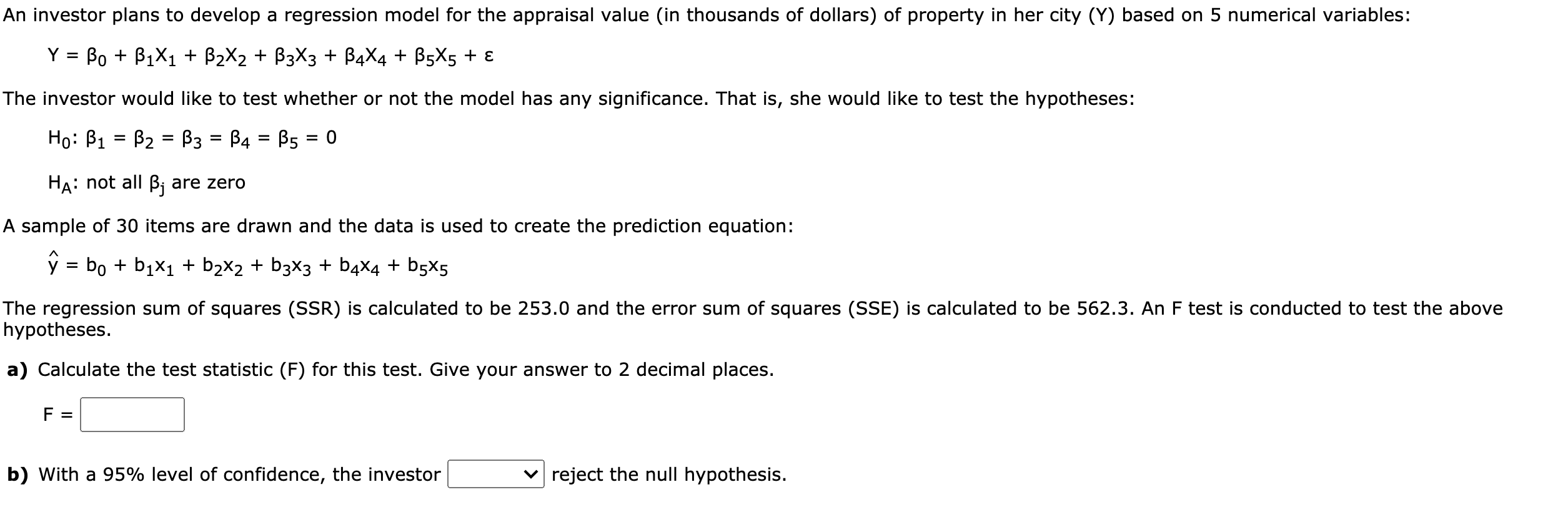

An investor plans to develop a regression model for the appraisal value (in thousands of dollars) of property in her city (Y) based on 5 numerical variables: Y = 50 + B1X1 + 32x2 + B3X3 + |34X4 + |35X5 + 5 The investor would like to test whether or not the model has any signicance. That is, she would like to test the hypotheses: H0=B1=l32=l33=l34=l35= HA: not all [Sj are zero A sample of 30 items are drawn and the data is used to create the prediction equation: 9: be + 131x1 + 132x2 + b3X3 + b4x4 + b5x5 The regression sum of squares (SSR) is calculated to be 253.0 and the error sum of squares (SSE) is calculated to be 562.3. An F test is conducted to test the above hypotheses. a) Calculate the test statistic (F) for this test. Give your answer to 2 decimal places. b) With a 95% level of condence, the investor v reject the null hypothesis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts