Question: An organization is examining four mutually exclusive alternatives; Alpha, Beta, Gamma, and Delta. You can assume that each alternative represents a simple investment in which

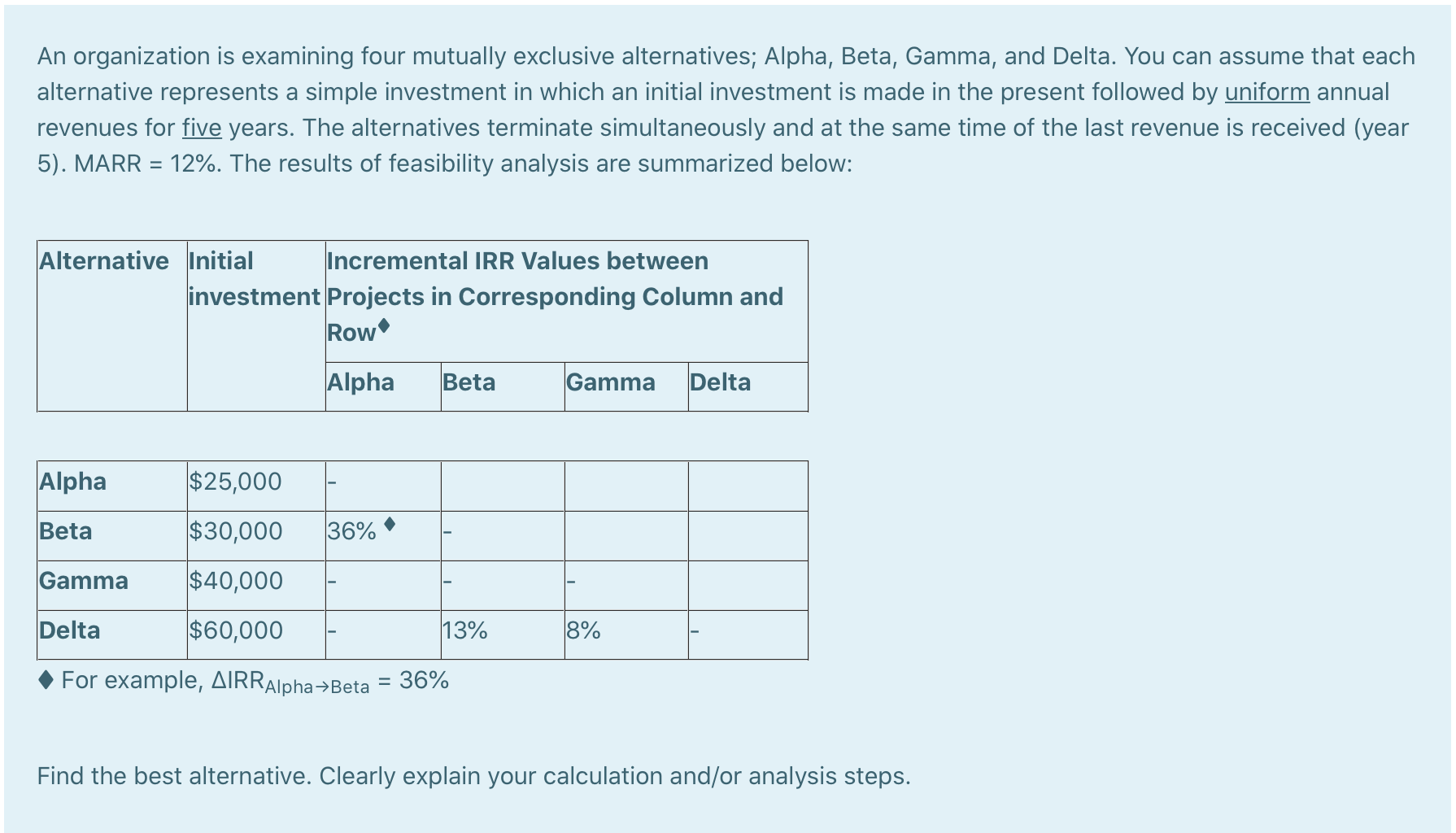

An organization is examining four mutually exclusive alternatives; Alpha, Beta, Gamma, and Delta. You can assume that each alternative represents a simple investment in which an initial investment is made in the present followed by uniform annual revenues for five years. The alternatives terminate simultaneously and at the same time of the last revenue is received (year 5). MARR = 12%. The results of feasibility analysis are summarized below: Alternative Initial Incremental IRR Values between investment Projects in Corresponding Column and Row Alpha Beta Gamma Delta Alpha $25,000 Beta $30,000 36% Gamma $40,000 Delta $60,000 13% 8% For example, AIRRAlpha-Beta = 36% Find the best alternative. Clearly explain your calculation and/or analysis steps. An organization is examining four mutually exclusive alternatives; Alpha, Beta, Gamma, and Delta. You can assume that each alternative represents a simple investment in which an initial investment is made in the present followed by uniform annual revenues for five years. The alternatives terminate simultaneously and at the same time of the last revenue is received (year 5). MARR = 12%. The results of feasibility analysis are summarized below: Alternative Initial Incremental IRR Values between investment Projects in Corresponding Column and Row Alpha Beta Gamma Delta Alpha $25,000 Beta $30,000 36% Gamma $40,000 Delta $60,000 13% 8% For example, AIRRAlpha-Beta = 36% Find the best alternative. Clearly explain your calculation and/or analysis steps

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts