Question: s and Unless otherwise indicated, exercises and problems should be solved based on IFRS 4. On January 1, Year 1, an entity acquires a new

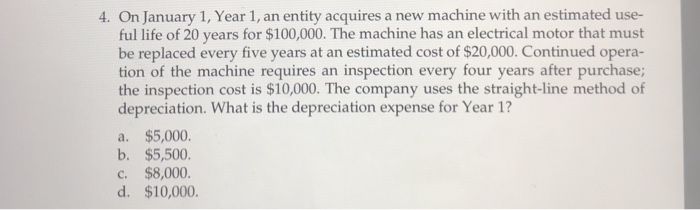

s and Unless otherwise indicated, exercises and problems should be solved based on IFRS 4. On January 1, Year 1, an entity acquires a new machine with an estimated use- ful life of 20 years for $100,000. The machine has an electrical motor that must be replaced every five years at an estimated cost of $20,000. Continued opera- tion of the machine requires an inspection every four years after purchase; the inspection cost is $10,000. The company uses the straight-line method of depreciation. What is the depreciation expense for Year 1? a. $5,000. b $5,500. c. $8,000. d. $10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts