Question: an original answer please 32. Arbitrage and PPP Assume that locational arbi- trage ensures that spot exchange rates are properly aligned. Also assume that you

an original answer please

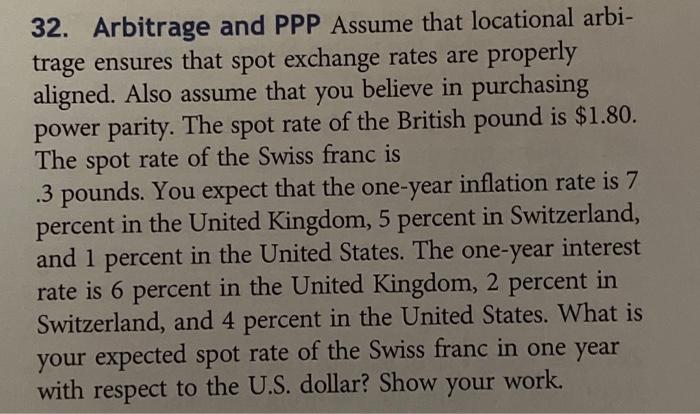

32. Arbitrage and PPP Assume that locational arbi- trage ensures that spot exchange rates are properly aligned. Also assume that you believe in purchasing power parity. The spot rate of the British pound is $1.80. The spot rate of the Swiss franc is .3 pounds. You expect that the one-year inflation rate is 7 percent in the United Kingdom, 5 percent in Switzerland, 5 and 1 percent in the United States. The one-year interest rate is 6 percent in the United Kingdom, 2 percent in Switzerland, and 4 percent in the United States. What is your expected spot rate of the Swiss franc in one year with respect to the U.S. dollar? Show your work

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock