Question: an original answer please 53. Forward versus Option Hedge Assume that interest rate parity exists. Today the one-year interest rate in Japan is the same

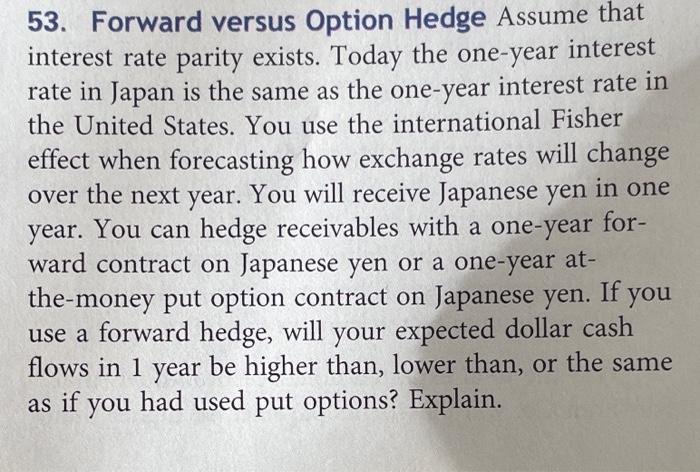

53. Forward versus Option Hedge Assume that interest rate parity exists. Today the one-year interest rate in Japan is the same as the one-year interest rate in the United States. You use the international Fisher effect when forecasting how exchange rates will change over the next year. You will receive Japanese yen in one year. You can hedge receivables with a one-year for- ward contract on Japanese yen or a one-year at- the-money put option contract on Japanese yen. If you use a forward hedge, will your expected dollar cash flows in 1 year be higher than, lower than, or the same as if you had used put options? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts