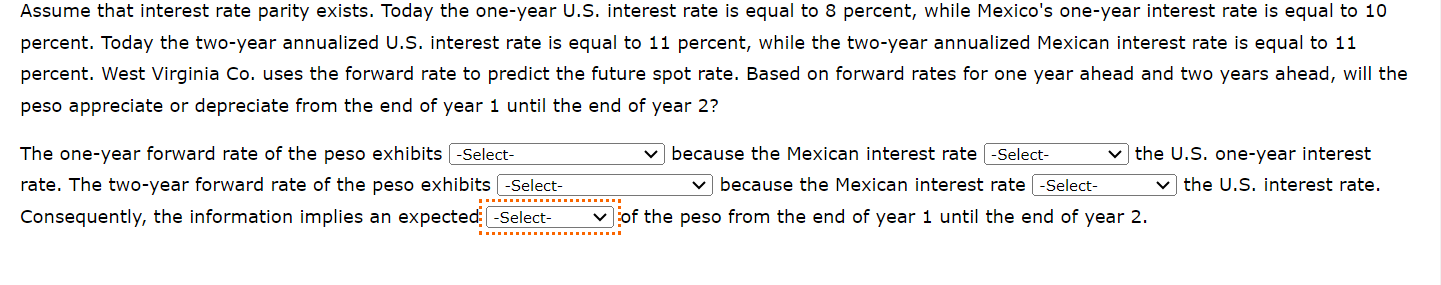

Question: Blank 1 options: a premium, a discount, or no premium or discount Blank 2: exceeds, is the same as, or is less than Blank 3:

Blank 1 options: a premium, a discount, or no premium or discount

Blank 2: exceeds, is the same as, or is less than

Blank 3: a premium, a discount, or no premium or discount

Blank 4: exceeds, is the same as, or is less than

Blank 5: appreciation, depreciation

Assume that interest rate parity exists. Today the one-year U.S. interest rate is equal to 8 percent, while Mexico's one-year interest rate is equal to 10 percent. Today the two-year annualized U.S. interest rate is equal to 11 percent, while the two-year annualized Mexican interest rate is equal to 11 percent. West Virginia Co. uses the forward rate to predict the future spot rate. Based on forward rates for one year ahead and two years ahead, will the peso appreciate or depreciate from the end of year 1 until the end of year 2 ? The one-year forward rate of the peso exhibits | rate. The two-year forward rate of the peso exhibits Consequently, the information implies an expected: because the Mexican interest rate because the Mexican interest rate the U.S. one-year interest the U.S. interest rate. of the peso from the end of year 1 until the end of year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts