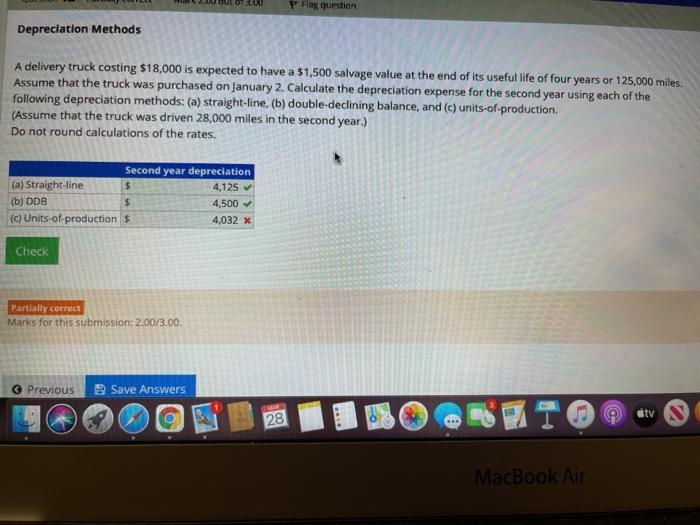

Question: AN OUE OT 8.0 p Flag question Depreciation Methods A delivery truck costing $18,000 is expected to have a $1,500 salvage value at the end

AN OUE OT 8.0 p Flag question Depreciation Methods A delivery truck costing $18,000 is expected to have a $1,500 salvage value at the end of its useful life of four years or 125,000 miles Assume that the truck was purchased on January 2. Calculate the depreciation expense for the second year using each of the following depreciation methods: (a) straight-line, (b) double-declining balance, and (c) units-of-production, (Assume that the truck was driven 28,000 miles in the second year.) Do not round calculations of the rates. Second year depreciation (a) Straight-line $ 4,125 (b) DDB $ 4,500 (c) Units-of-production $ 4,032 X Check Partially correct Marks for this submission: 2.00/3.00.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts