Question: Anal Examination (Optional) MASTERING PAYROLL Instructions: Detach the Final Examination Answer Sheet on page 403 before beginning your final examination. Select the correct letter for

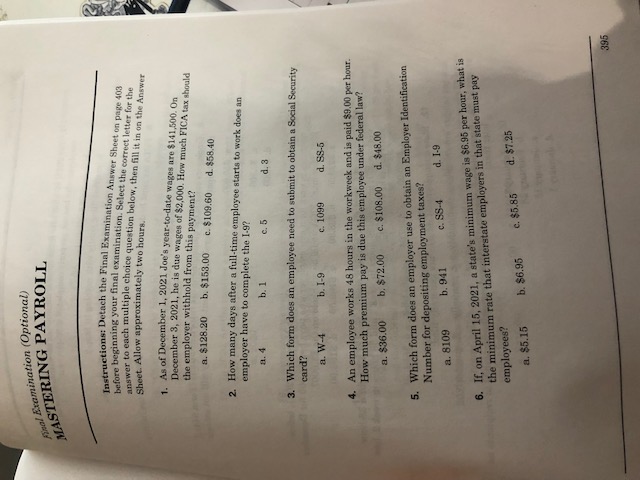

Anal Examination (Optional) MASTERING PAYROLL Instructions: Detach the Final Examination Answer Sheet on page 403 before beginning your final examination. Select the correct letter for the Sheet. Allow approximately two hours. answer to each multiple choice question below, then fill it in on the Answer 1. As of December 1, 2021 Joe's year-to-date wages are $141,500. On December 3, 2021, he is due wages of $2,000. How much FICA tax should the employer withhold from this payment? a. $128.20 b. $153.00 c. $109.60 d. $58.40 2. How many days after a full-time employee starts to work does an employer have to complete the I-9? 1.4 b. 1 c. 5 d. 3 3. Which form does an employee need to submit to obtain a Social Security card? a. W-4 b. I-9 c. 1099 d. SS-5 4. An employee works 48 hours in the workweek and is paid $9.00 per hour. How much premium pay is due this employee under federal law? a. $36.00 b. $72.00 c. $108.00 d. $48.00 5. Which form does an employer use to obtain an Employer Identification Number for depositing employment taxes? a 8109 b. 941 c. SS-4 d. 1-9 6. If, on April 15, 2021, a state's minimum wage is $6.95 per hour, what is the minimum rate that interstate employers in that state must pay employees? a. $5.15 b. $6.95 e. $5.85 d. $7.25 395

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts