Question: Examination ( Optional ) TERING PAYROLL Instructions: Detach the Final Examination Answer Sheet on page 4 1 9 before beginning your final examination. Select the

Examination Optional

TERING PAYROLL

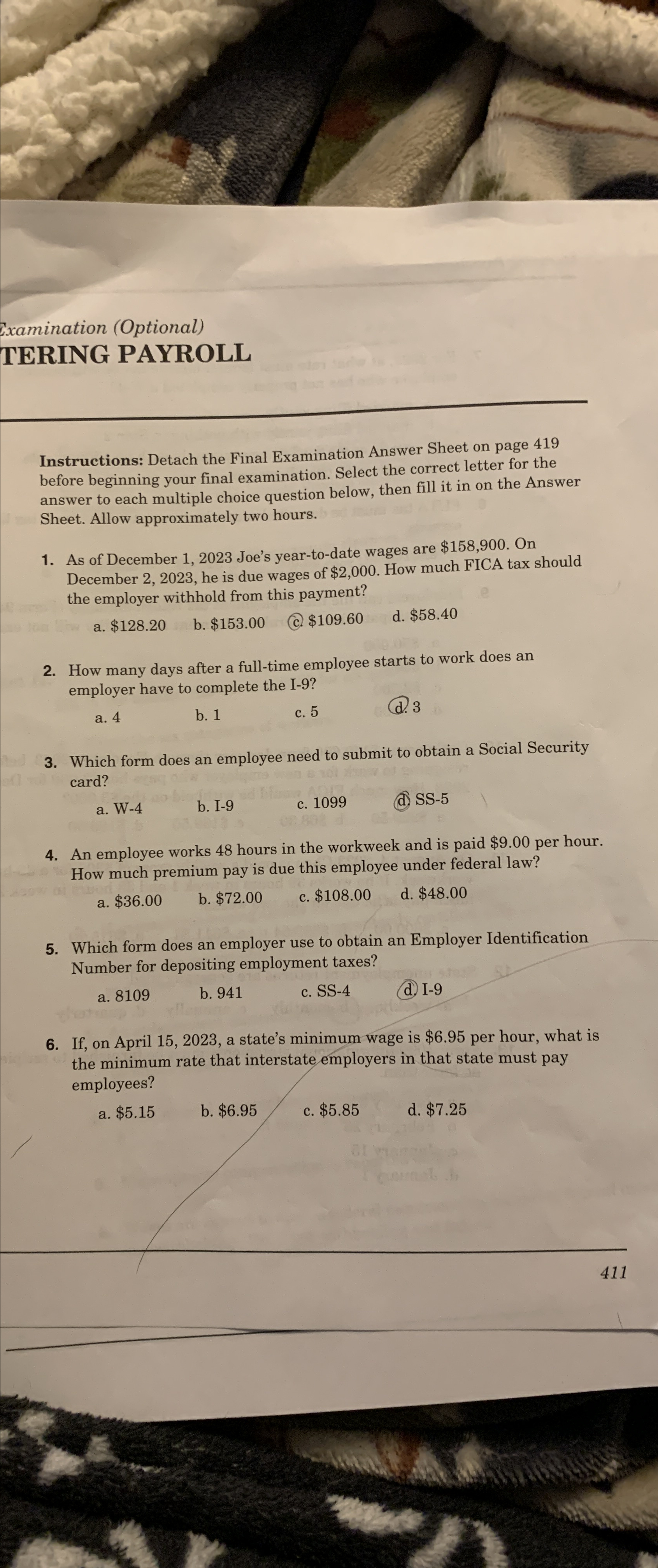

Instructions: Detach the Final Examination Answer Sheet on page before beginning your final examination. Select the correct letter for the answer to each multiple choice question below, then fill it in on the Answer Sheet. Allow approximately two hours.

As of December Joe's yeartodate wages are $ On December he is due wages of $ How much FICA tax should the employer withhold from this payment?

a $

b $

c $

d $

How many days after a fulltime employee starts to work does an employer have to complete the I

a

b

c

d

Which form does an employee need to submit to obtain a Social Security card?

a W

b I

c

d

An employee works hours in the workweek and is paid $ per hour. How much premium pay is due this employee under federal law?

a $

b $

c $

d $

Which form does an employer use to obtain an Employer Identification Number for depositing employment taxes?

a

b

c SS

d I

If on April a state's minimum wage is $ per hour, what is the minimum rate that interstate employers in that state must pay employees?

a $

b $

c $

d $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock