Question: Analyse the case. Highlight the problems and answer the questions. Provide specifics wherever needed (For eg: when suggesting a course of action or a plan).

Analyse the case. Highlight the problems and answer the questions. Provide specifics wherever needed (For eg: when suggesting a course of action or a plan).

You can start by briefing on the industry and the background of the organisation in question. Also, comment on the underlying concepts for each case. Ensure that whatever points are presented are logical and backed by evidence.

Case Study-Havells India Ltd.

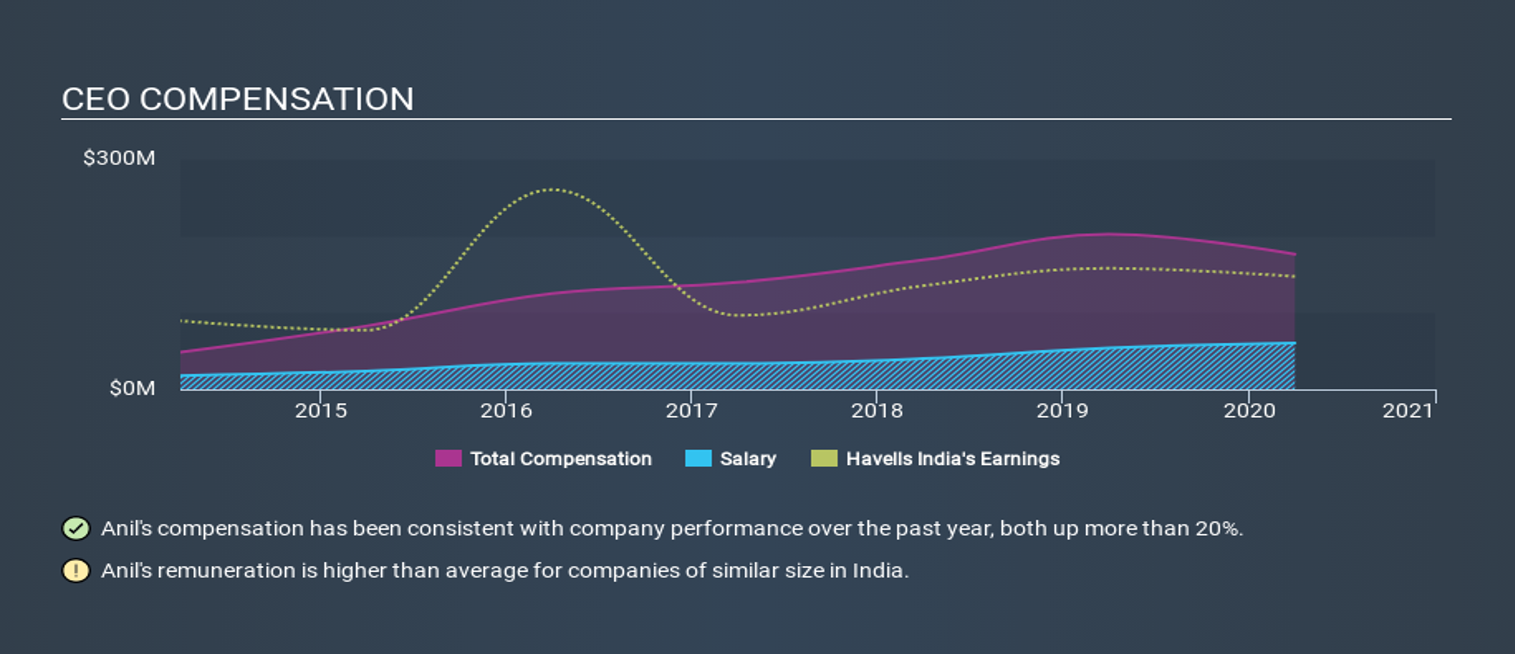

Anil Gupta has been the CEO of Havells India Limited since 2014. First, this article will compare CEO compensation with compensation at similar sized companies. Secondly, a snapshot of the business growth is looked at. Third, the article reflects on the total return to shareholders over three years, as a second measure of business performance. The aim of all this is to consider the appropriateness of CEO pay levels.

As of June 7,2020, Havells India Limited has a market cap of ?355b, and reported total annual CEO compensation of ?176m for the year to March 2020. That is below the compensation, last year. While this analysis focuses on total compensation, it is worth noting the salary is lower, valued at ?60m. Importantly, there may be performance hurdles relating to the non-salary component of the total compensation. When looked at a group of companies with market capitalizations from ?151b to ?484b, the median CEO total compensation was ?60m.

On a sector level, around 91% of total compensation represents salary and 9.0% is other remuneration. It is interesting to note that Havells India allocates a smaller portion of compensation to salary in comparison to the broader industry.

As one can observe, Anil Gupta is paid more than the median CEO pay at companies of a similar size, in the same market. However, this does not necessarily mean Havells India Limited is paying too much. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous. A visual representation of the CEO compensation at Havells India is given below.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts