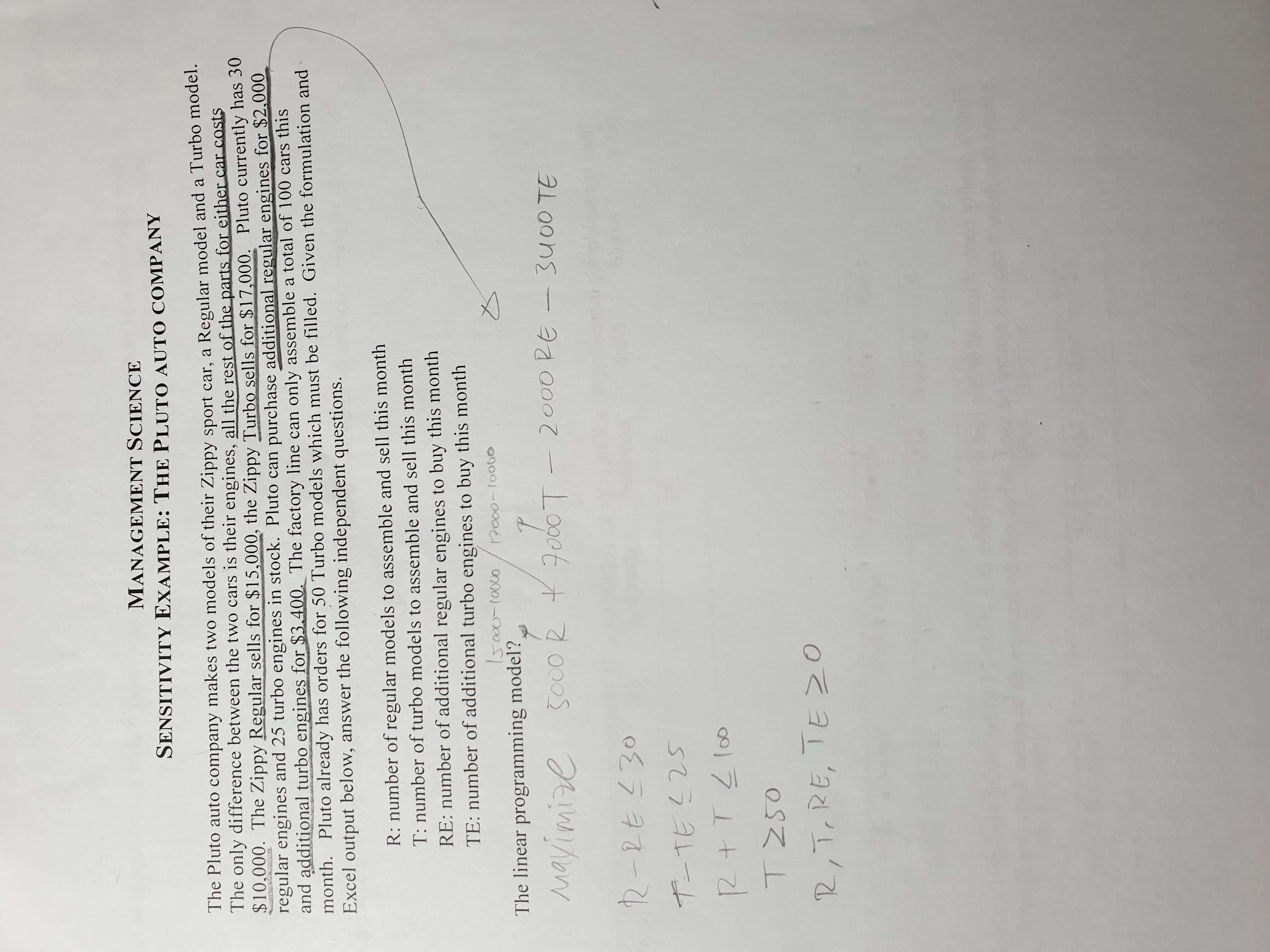

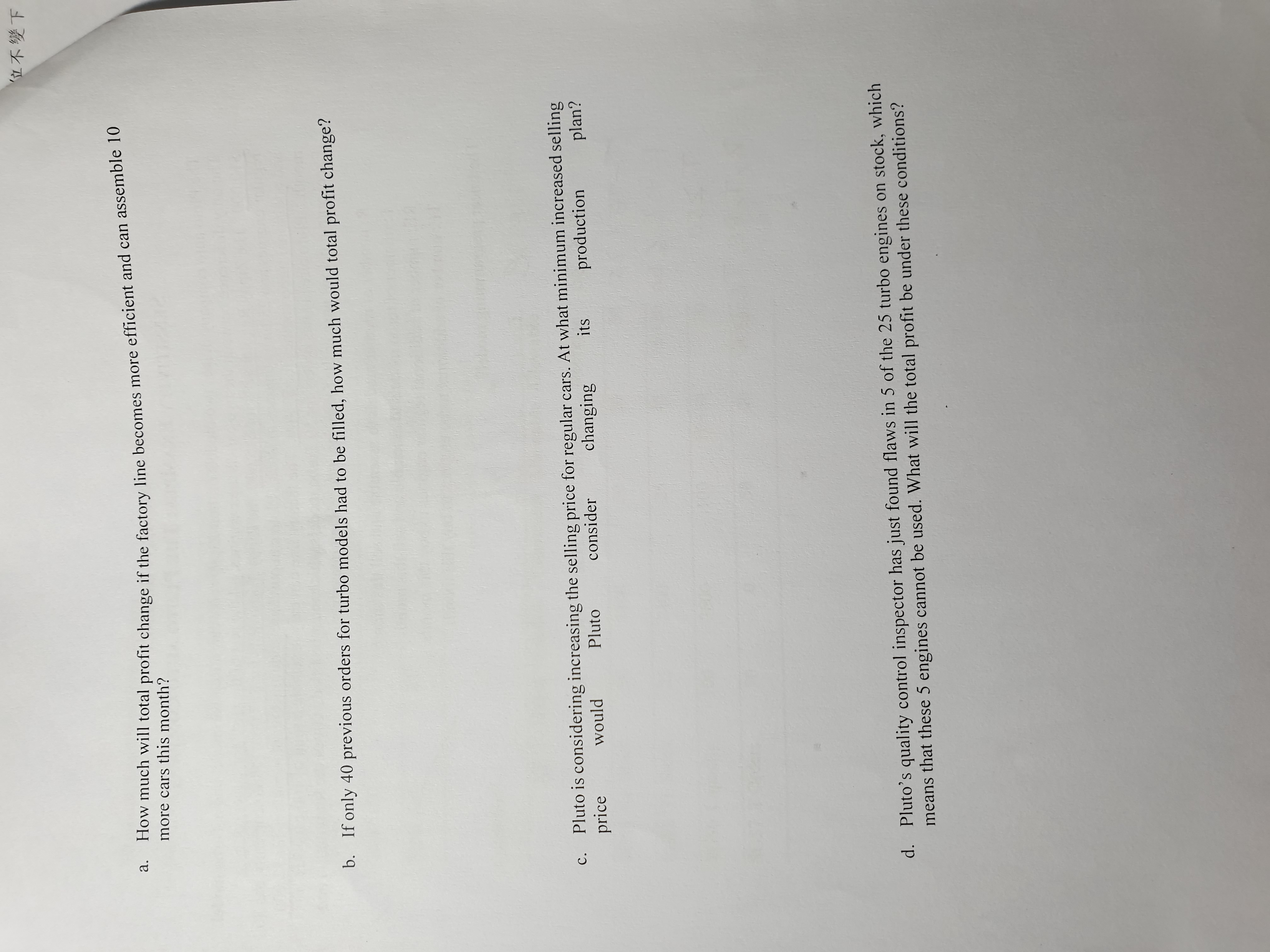

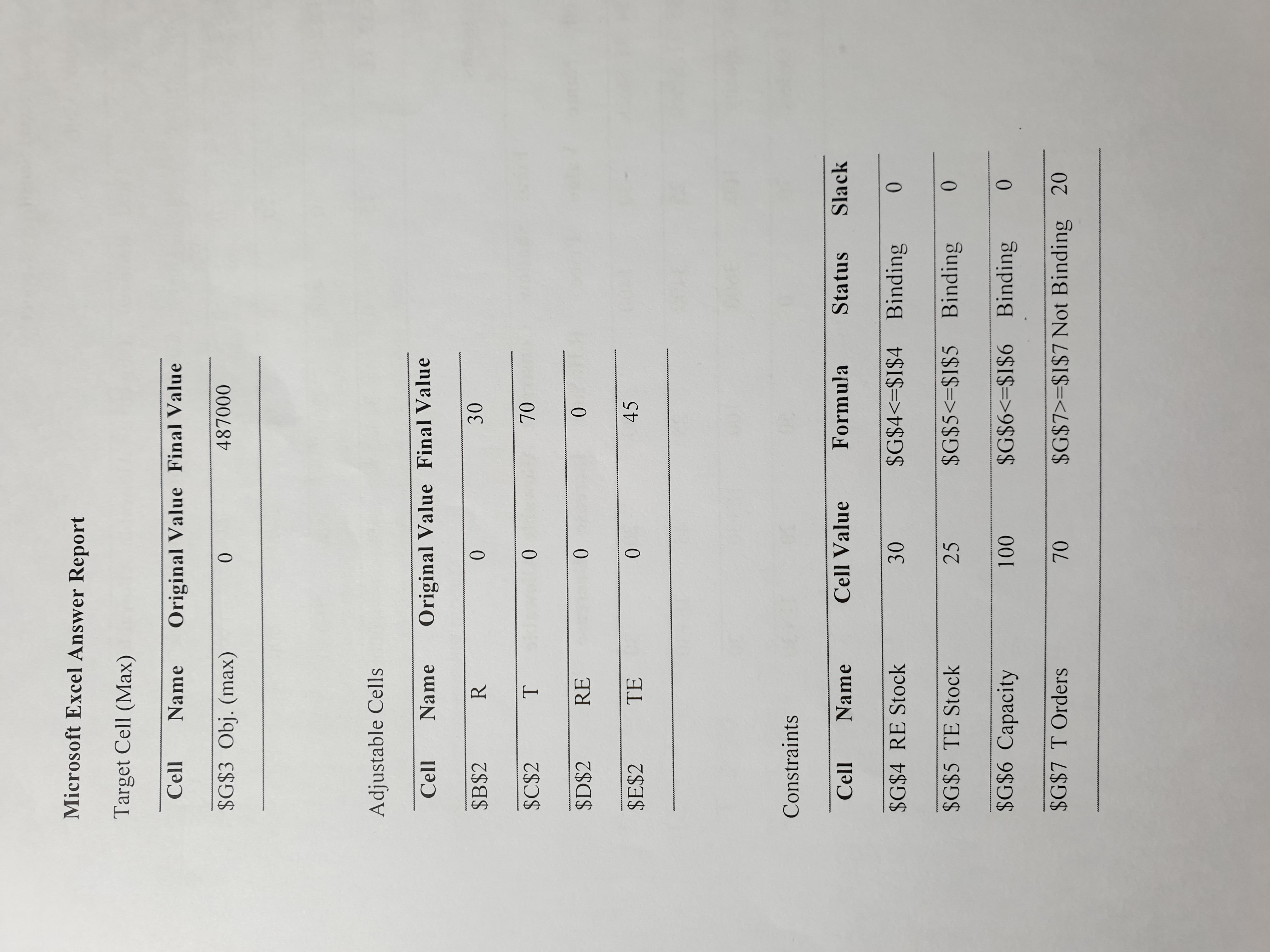

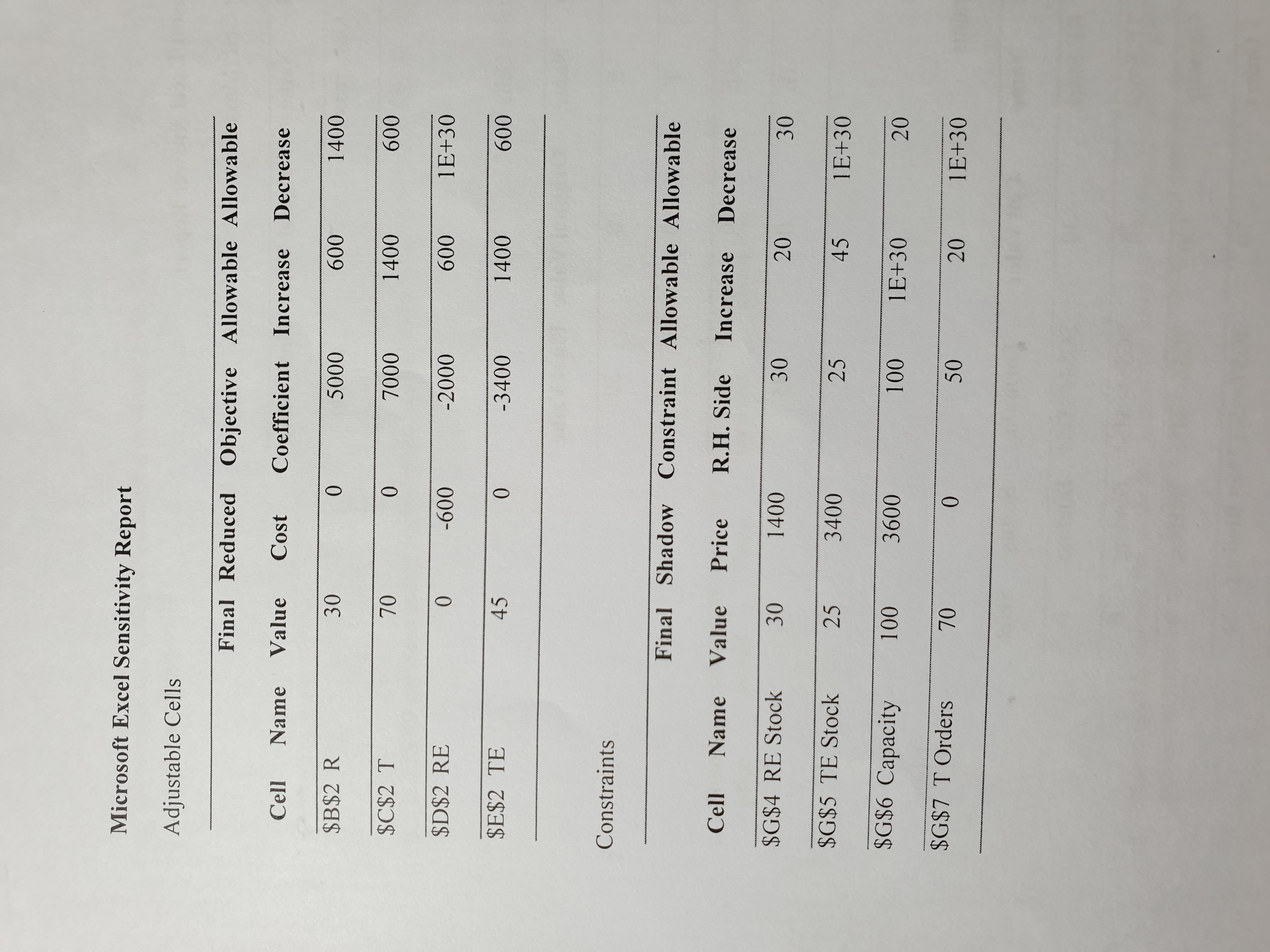

Question: MANAGEMENT SCIENCE SENSITIVITY EXAMPLE: THE PLUTO AUTO COMPANY The Pluto auto company makes two models of their Zippy sport car, a Regular model and a

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock