Question: Analysis and Recommend Case 12-2 Analysis and Recommend Case 12-2 Case 12-2 Kettering Industries Inc. In late February, Victoria Jackson, supply manager at Kettering Industries

Analysis and Recommend Case 12-2

Analysis and Recommend Case 12-2

Analysis and Recommend Case 12-2

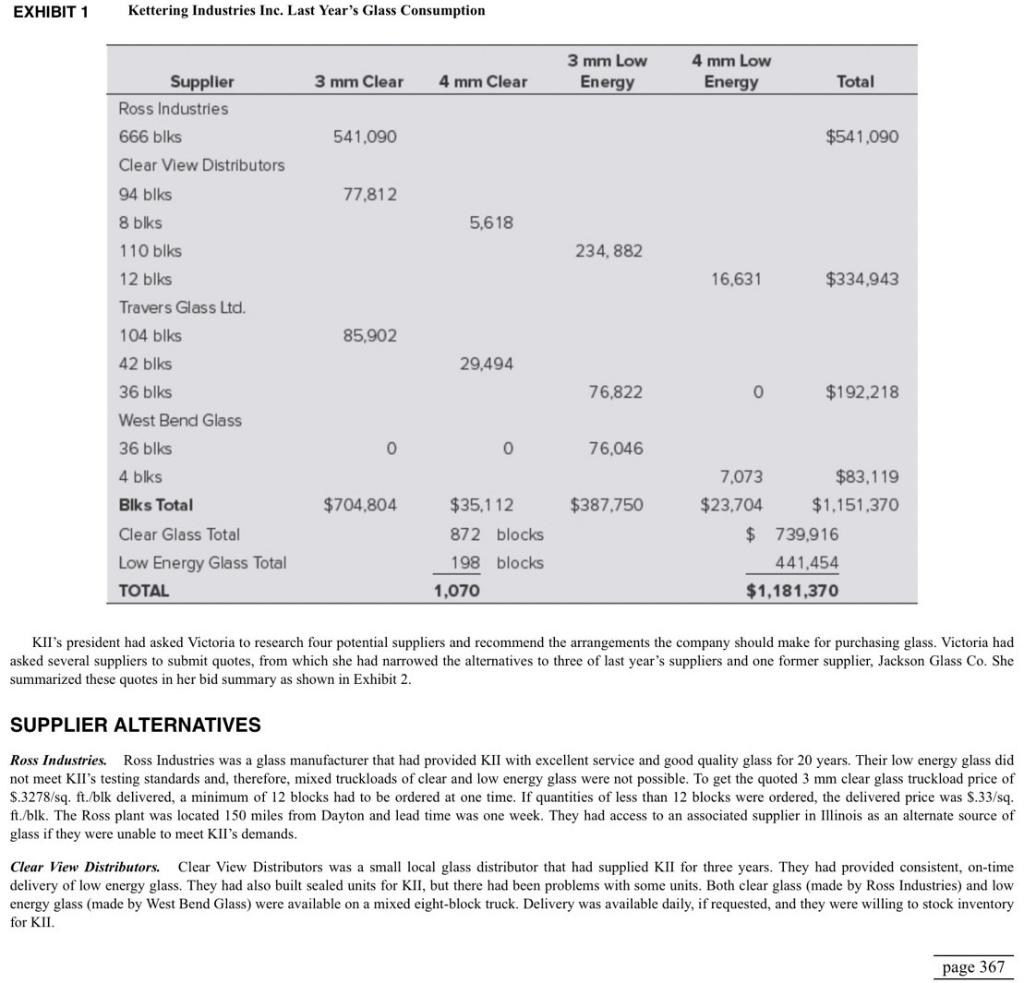

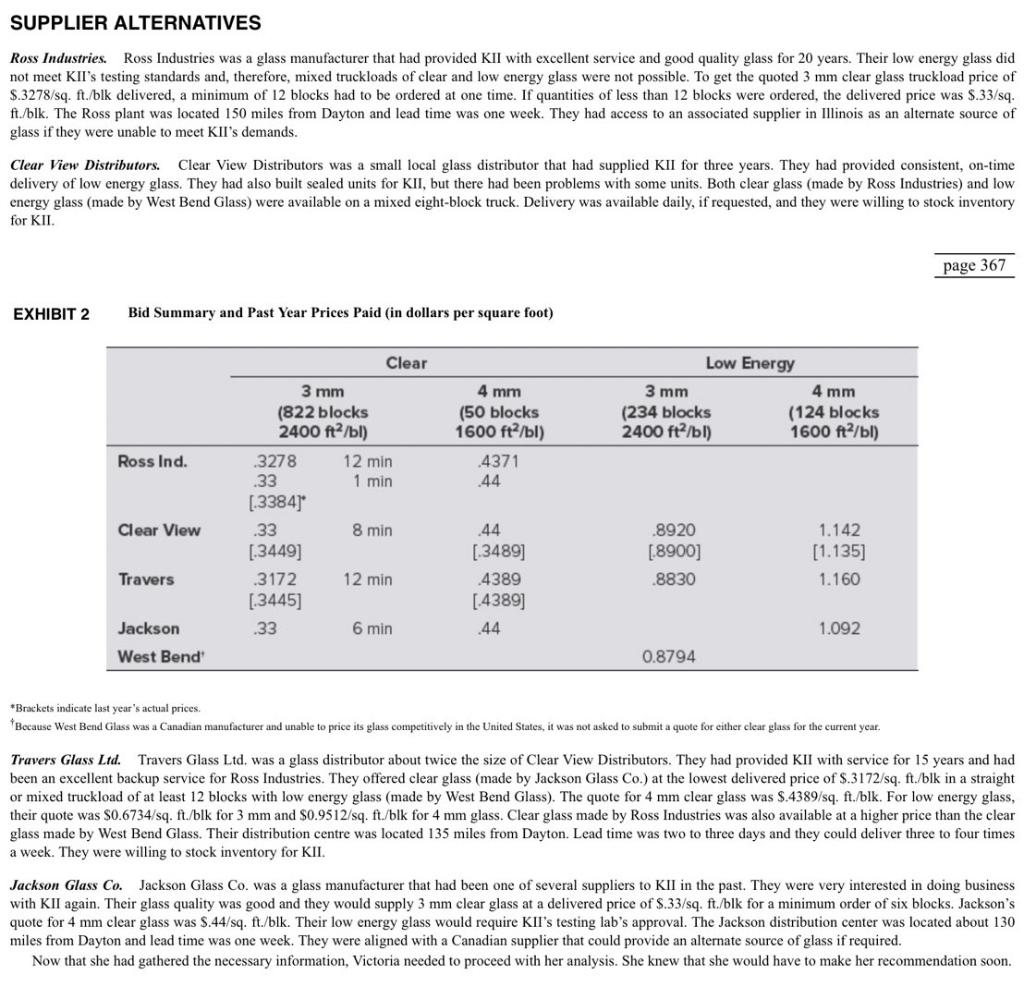

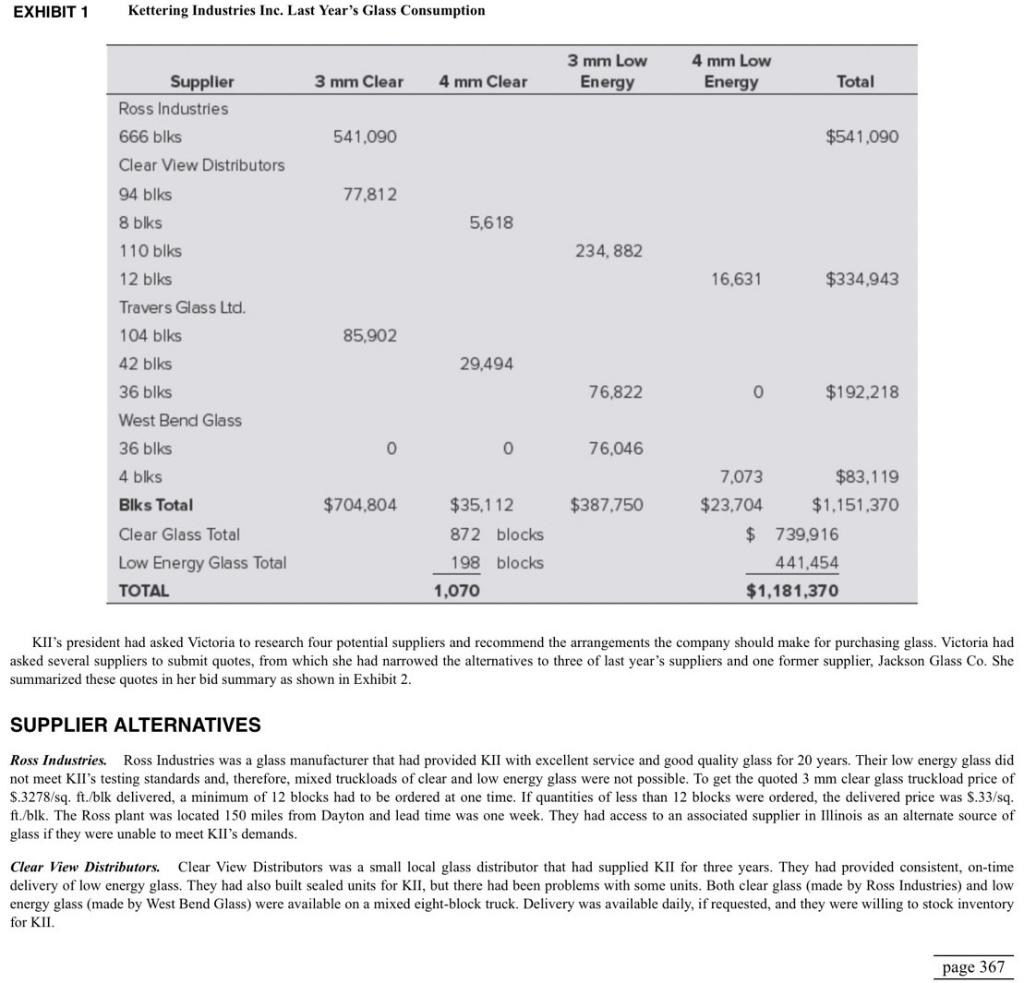

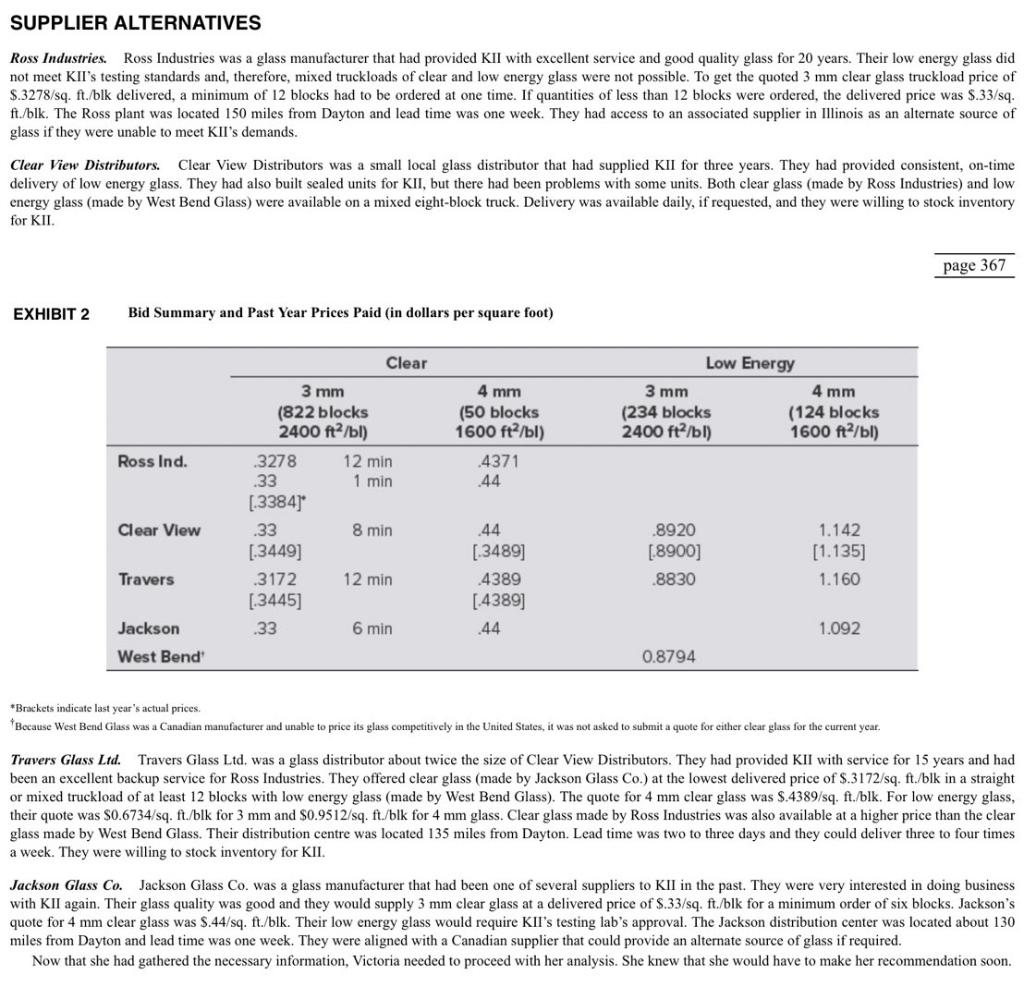

Case 12-2 Kettering Industries Inc. In late February, Victoria Jackson, supply manager at Kettering Industries Inc. in Dayton, Ohio, needed to decide which glass supplier(s) to choose. She was not sure whether her past approach to buying glass would still be appropriate in future. KETTERING INDUSTRIES INC. Kettering Industries Inc. (KII) competed in the regional window market in the Midwest home remodeling industry. The plant initially manufactured low-cost products such as storm doors, storm windows, school bus windows, and low-end replacement aluminum windows. Over the years, storm door and replacement aluminum window production was eliminated and vinyl window production was initiated. The 86,000 sq. ft. facility manufactured vinyl windows (800/day), storm windows (200/day), and school bus aluminum windows (50/day). A total of 160,000 windows was produced last year. Sales were approximately $25 million. Sales of vinyl windows were seasonal with primary demand in the warmer months, from May to October. The company sold its high-priced, high-quality vinyl windows through a number of branches located across the Midwest. The delivery goal to customers was 10 days from the date the order was received at the plant. In order to maintain competitiveness and increase returns to shareholders, KlI was committed to becoming a world-class manufacturer. Programs were developed and implemented to meet goals of improved quality, delivery performance, customer responsiveness, and better engineered products. VINYL WINDOW PRODUCTION All production at KII was based on custom orders. Windows were usually manufactured and shipped on the same day, reducing the need for work-in-process inventory. Due to cost and performance advantages of vinyl over wood and aluminum windows, management projected that demand would continue to grow, and production, as measured by total blocks of glass used, would double over the next five years. All of this growth was expected to be in low energy glass windows. Vinyl windows could be made with either clear glass or low energy glass, both types of glass were available in thicknesses of each 3 mm or 4 mm. Low energy glass was a special glass with an invisible metal coating that reduced penetration of infrared rays and decreased heat loss. Currently, low energy glass windows accounted for about 22 percent of the plant's vinyl window production. Low energy glass window production, as a percentage of total vinyl window production, was increasing monthly PURCHASING OF GLASS Last year, KII purchased a total of $1.15 million of clear and low energy glass from four different suppliers (Exhibit 1). Glass was purchased by the block with each block consisting of 40 sheets for 4 mm glass and 50 sheets for 3 mm glass. Due to the nature of the glass-cutting equipment that the company used, 3 mm glass had to be ordered in sheets of 72' x 96' and 4 mm glass in sheets of 60' x 96'. Glass sheet order quantities were determined based on historical usage reports and sales forecasts. In order to take advantage of quantity discounts and obtain the best possible price, Victoria usually ordered by the truckload. Truckload size could vary between 8 to 18 blocks depending on the capacity of the truck, the packaging, and weight restrictions The amount of glass that could be held in inventory was constrained by a storage capacity of 32 blocks. During the past year, to maintain production during peak periods (May through October), six blocks of glass per day were required. Only 13 blocks of glass per week were needed for the November through April period. Each week, an inventory count was undertaken so that orders could be adjusted as necessary. Last year, raw material glass inventory turned about 14 times. KII occasionally manufactured products using obscure glass instead of clear or low energy glass. Rather than stocking the obscure glass in inventory it was only ordered as required. SELECTING SUPPLIERS Victoria wanted one or more suppliers to be able to meet forecasted needs. The company had set a goal of increasing raw material inventory turns from 14 times a year to 30-35 times a year within two years. In addition to requiring less working capital, increased inventory turns would free up floor space that was needed for other production activities. A Vendor Certification Program was also being implemented to assist in the setup of long-term relationships with suppliers in a partnership mode to encourage delivery of on-time, zero-defect materials to the plant page 366 EXHIBIT 1 Kettering Industries Inc. Last Year's Glass Consumption 3 mm Low Energy 3 mm Clear 4 mm Clear 4 mm Low Energy Total 541,090 $541,090 77,812 5.618 234, 882 16,631 $334,943 Supplier Ross Industries 666 blks Clear View Distributors 94 blks 8 blks 110 blks 12 blks Travers Glass Ltd. 104 blks 42 blks 36 blks West Bend Glass 36 blks 4 blks Blks Total 85,902 29.494 76,822 0 $192,218 0 0 76,046 $704,804 $35,112 $387.750 872 blocks Clear Glass Total Low Energy Glass Total TOTAL 7,073 $83,119 $23,704 $1,151,370 $ 739,916 441,454 $1,181,370 198 blocks 1,070 KII's president had asked Victoria to research four potential suppliers and recommend the arrangements the company should make for purchasing glass. Victoria had asked several suppliers to submit quotes, from which she had narrowed the alternatives to three of last year's suppliers and one former supplier, Jackson Glass Co. She summarized these quotes in her bid summary as shown in Exhibit 2. SUPPLIER ALTERNATIVES Ross Industries. Ross Industries was a glass manufacturer that had provided KII with excellent service and good quality glass for 20 years. Their low energy glass did not meet KII's testing standards and therefore, mixed truckloads of clear and low energy glass were not possible. To get the quoted 3 mm clear glass truckload price of $.3278/sq. ft./blk delivered, a minimum of 12 blocks had to be ordered at one time. If quantities of less than 12 blocks were ordered, the delivered price was S.33/sq. ft./blk. The Ross plant was located 150 miles from Dayton and lead time was one week. They had access to an associated supplier in Illinois as an alternate source of glass if they were unable to meet KII's demands. Clear View Distributors. Clear View Distributors was a small local glass distributor that had supplied KII for three years. They had provided consistent, on-time delivery of low energy glass. They had also built sealed units for KII, but there had been problems with some units. Both clear glass (made by Ross Industries) and low energy glass (made by West Bend Glass) were available on a mixed eight-block truck. Delivery was available daily, if requested, and they were willing to stock inventory for KII. page 367 SUPPLIER ALTERNATIVES Ross Industries. Ross Industries was a glass manufacturer that had provided KII with excellent service and good quality glass for 20 years. Their low energy glass did not meet KII's testing standards and, therefore, mixed truckloads of clear and low energy glass were not possible. To get the quoted 3 mm clear glass truckload price of $.3278/sq. ft./blk delivered, a minimum of 12 blocks had to be ordered at one time. If quantities of less than 12 blocks were ordered, the delivered price was $.33/sq. ft./blk. The Ross plant was located 150 miles from Dayton and lead time was one week. They had access to an associated supplier in Illinois as an alternate source of glass if they were unable to meet KII's demands. Clear View Distributors. Clear View Distributors was a small local glass distributor that had supplied Kll for three years. They had provided consistent, on-time delivery of low energy glass. They had also built sealed units for KII, but there had been problems with some units. Both clear glass (made by Ross Industries) and low energy glass (made by West Bend Glass) were available on a mixed eight-block truck. Delivery was available daily, if requested, and they were willing to stock inventory for KII page 367 EXHIBIT 2 Bid Summary and Past Year Prices Paid (in dollars per square foot) 4 mm Low Energy 3 mm 4 mm (234 blocks (124 blocks 2400 ft/b1) 1600 ft/bl) (50 blocks 1600 ft/bl) 4371 .44 Ross Ind. Clear 3 mm (822 blocks 2400 ft/bl) 3278 12 min .33 1 min [.3384) .33 8 min [.3449] .3172 12 min [.3445] .33 6 min Clear View 44 [.3489) 4389 [.4389) 44 .8920 [8900] .8830 1.142 [1.135] 1.160 Travers 1.092 Jackson West Bend 0.8794 *Brackets indicate last year's actual prices. * Because West Bend Glass was a Canadian manufacturer and unable to price its glass competitively in the United States, it was not asked to submit a quote for either clear glass for the current year. Travers Glass Ltd. Travers Glass Ltd. was a glass distributor about twice the size of Clear View Distributors. They had provided KII with service for 15 years and had been an excellent backup service for Ross Industries. They offered clear glass (made by Jackson Glass Co.) at the lowest delivered price of $.3172/sq. ft./blk in a straight or mixed truckload of at least 12 blocks with low energy glass (made by West Bend Glass). The quote for 4 mm clear glass was $.4389/sq. ft./blk. For low energy glass, their quote was $0.6734/sq. ft/blk for 3 mm and $0.9512/sq. ft/blk for 4 mm glass. Clear glass made by Ross Industries was also available at a higher price than the clear glass made by West Bend Glass. Their distribution centre was located 135 miles from Dayton. Lead time was two to three days and they could deliver three to four times a week. They were willing to stock inventory for KII Jackson Glass Co. Jackson Glass Co. was a glass manufacturer that had been one of several suppliers to KII in the past. They were very interested in doing business with KII again. Their glass quality was good and they would supply 3 mm clear glass at a delivered price of S.33/sq. ft./blk for a minimum order of six blocks. Jackson's quote for 4 mm clear glass was 5.44/sq. ft./blk. Their low energy glass would require KII's testing lab's approval. The Jackson distribution center was located about 130 miles from Dayton and lead time was one week. They were aligned with a Canadian supplier that could provide an alternate source of glass if required. Now that she had gathered the necessary information, Victoria needed to proceed with her analysis. She knew that she would have to make her recommendation soon

Analysis and Recommend Case 12-2

Analysis and Recommend Case 12-2