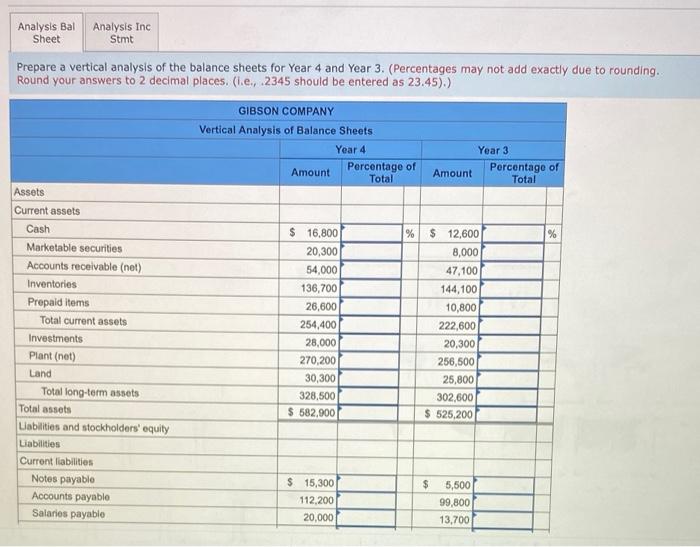

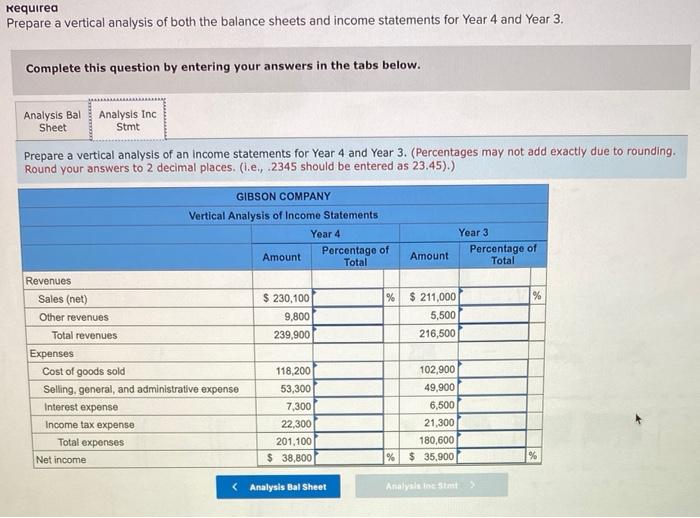

Question: Analysis Bal Sheet Analysis Inc Stmt Prepare a vertical analysis of the balance sheets for Year 4 and Year 3. (Percentages may not add

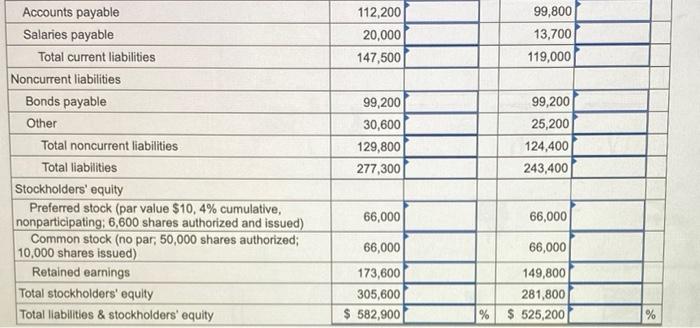

Analysis Bal Sheet Analysis Inc Stmt Prepare a vertical analysis of the balance sheets for Year 4 and Year 3. (Percentages may not add exactly due to rounding.. Round your answers to 2 decimal places. (i.e., .2345 should be entered as 23.45).) GIBSON COMPANY Vertical Analysis of Balance Sheets Year 4 Assets Current assets Amount Year 3 Percentage of Total Amount Percentage of Total Cash Marketable securities Accounts receivable (net) Inventories Prepaid items Total current assets Investments $ 16,800 % $ 12,600 % 20,300 8,000 54,000 47,100 136,700 144,100 26,600 10,800 254,400 222,600 28,000 20,300 Plant (net) 270,200 256,500 Land 30,300 25,800 Total long-term assets 328,500 302,600 Total assets $ 582,900 $525,200 Liabilities and stockholders' equity Liabilities Current liabilities Notes payable Accounts payable Salaries payable $ 15,300 $ 5,500 112,200 99,800 20,000 13,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts