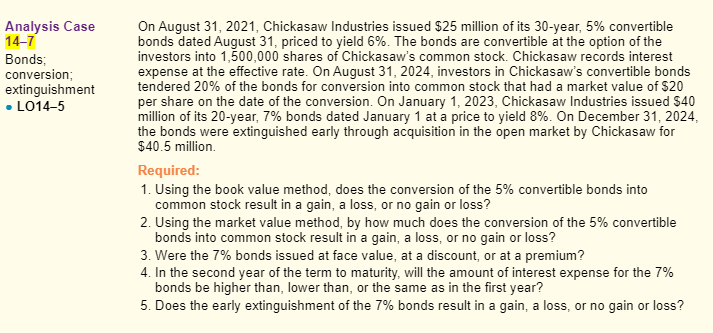

Question: Analysis Case 1 4 - 7 Bonds; conversion; extinguishment LO 1 4 - 5 On August 3 1 , 2 0 2 1 , Chickasaw

Analysis Case

Bonds;

conversion;

extinguishment

LO

On August Chickasaw Industries issued $ million of its year, convertible

bonds dated August priced to yield The bonds are convertible at the option of the

investors into shares of Chickasaw's common stock. Chickasaw records interest

expense at the effective rate. On August investors in Chickasaw's convertible bonds

tendered of the bonds for conversion into common stock that had a market value of $

per share on the date of the conversion. On January Chickasaw Industries issued $

million of its year, bonds dated January at a price to yield On December

the bonds were extinguished early through acquisition in the open market by Chickasaw for

$ million.

Required:

Using the book value method, does the conversion of the convertible bonds into

common stock result in a gain, a loss, or no gain or loss?

Using the market value method, by how much does the conversion of the convertible

bonds into common stock result in a gain, a loss, or no gain or loss?

Were the bonds issued at face value, at a discount, or at a premium?

In the second year of the term to maturity, will the amount of interest expense for the

bonds be higher than, lower than, or the same as in the first year?

Does the early extinguishment of the bonds result in a gain, a loss, or no gain or loss?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock