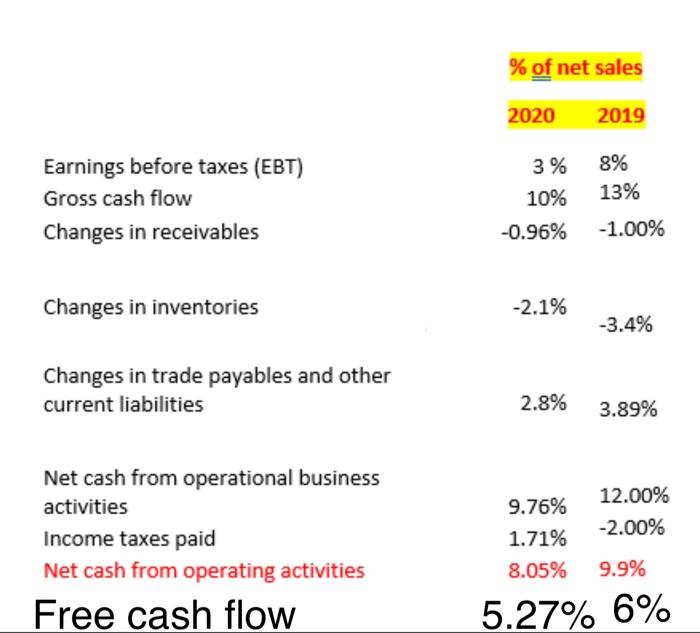

Question: Analyze and evaluate this common size cash flow statement the operating activities in details ( compare between 2020 & 2019 ) + evaluate the free

Analyze and evaluate this common size cash flow statement the operating activities in details (compare between 2020 & 2019) + evaluate the free cash flow

% of net sales 2020 2019 Earnings before taxes (EBT) Gross cash flow Changes in receivables 3 % 10% -0.96% 8% 13% -1.00% Changes in inventories -2.1% -3.4% Changes in trade payables and other current liabilities 2.8% 3.89% 12.00% -2.00% Net cash from operational business activities Income taxes paid Net cash from operating activities Free cash flow 9.76% 1.71% 8.05% 9.9% 5.27% 6%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock