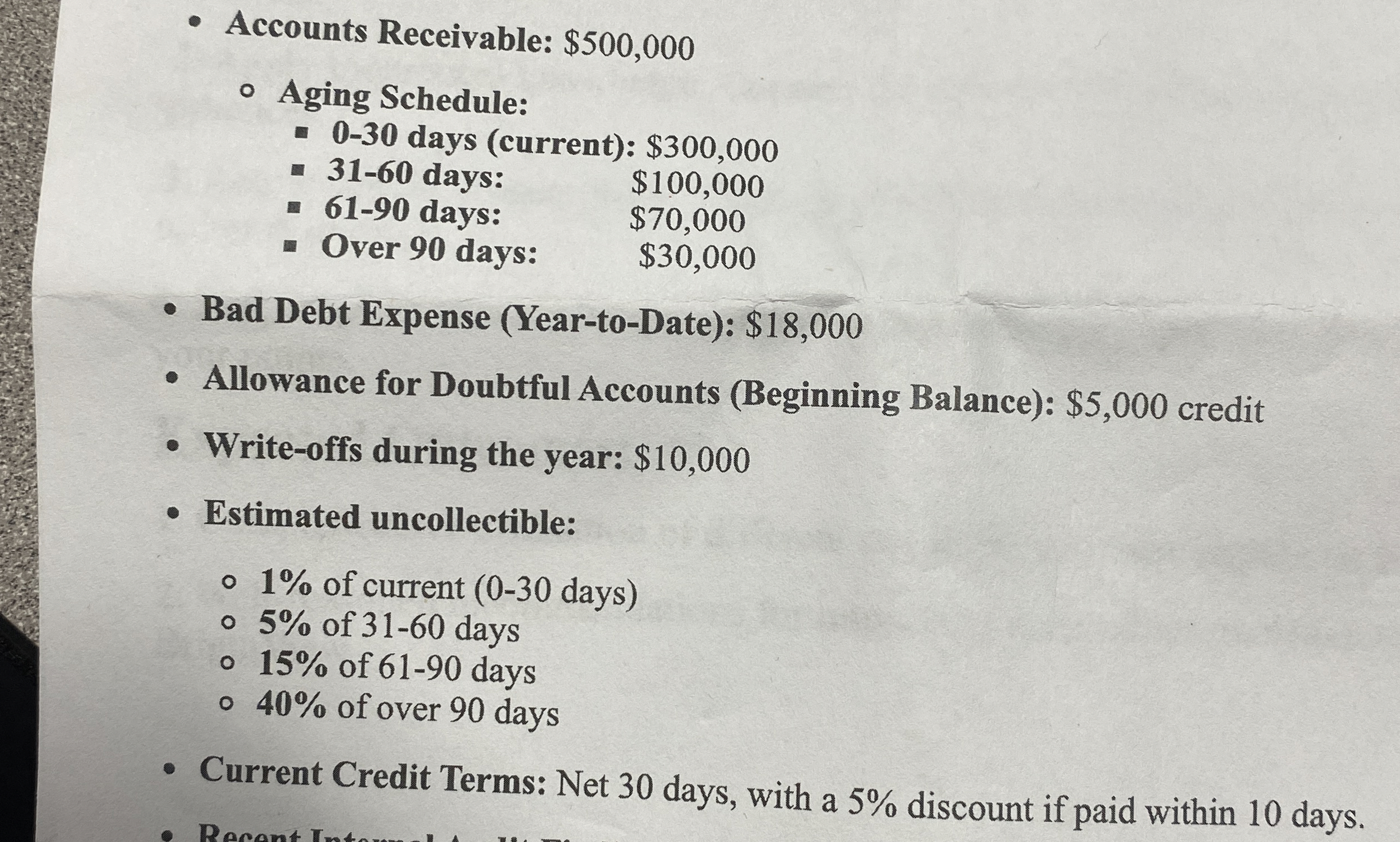

Question: Analyze the aging schedule and determine which receivables are most at risk of becoming uncollectible. Accounts Receivable: $ 5 0 0 , 0 0 0

Analyze the aging schedule and determine which receivables are most at risk of becoming uncollectible.

Accounts Receivable: $

Aging Schedule:

days current: $

days: $

days: $

Over days: $

Bad Debt Expense YeartoDate: $

Allowance for Doubtful Accounts Beginning Balance: $ credit

Writeoffs during the year: $

Estimated uncollectible:

of current days

of days

of days

of over days

Current Credit Terms: Net days, with a discount if paid within days.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock