Question: analyze the attached Seagate case. In your analysis, you should address the following questions: 1) Why is Seagate undertaking this transaction? Is it necessary to

analyze the attached Seagate case. In your analysis, you should address the following questions:

1) Why is Seagate undertaking this transaction? Is it necessary to divest the Veritas shares in a separate transaction? Who are the winners and losers resulting from the transaction? Given the benefits of leveraged buyouts (LBO's), is the rigid disk drive industry conducive to an LBO?

2)Luczo and the buyout team plan to finance their acquisition of Seagate's operating assets using a combination of debt and equity. How much debt would you recommend that they use? Why?

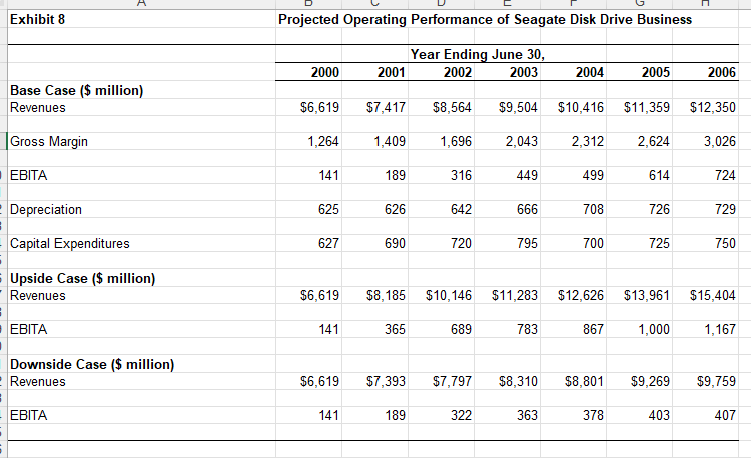

3)Based on the scenarios presented in Exhibit 8 and on your assessment of the optimal amount of debt in the deal structure and going forward, how much are Seagate's operating assets worth? Assume that of the $800 million in cash that the buyout team will acquire as part of the transaction, $500 million is required for net working capital and $300 million is excess cash.

A Exhibit 8 Projected Operating Performance of Seagate Disk Drive Business 2000 2001 Year Ending June 30, 2002 2003 2004 2005 2006 Base Case ($ million) Revenues $6,619 $7,417 $8,564 $9,504 $10,416 $11,359 $12,350 Gross Margin 1,264 1,409 1,696 2,043 2,312 2,624 3,026 EBITA 141 189 316 449 499 614 724 Depreciation 625 626 642 666 708 726 729 Capital Expenditures 627 690 720 795 700 725 750 Upside Case ($ million) Revenues $6,619 $8,185 $10,146 $11,283 $12,626 $13,961 $15,404 EBITA 141 365 689 783 867 1,000 1,167 Downside Case ($ million) Revenues $6,619 $7,393 $7,797 $8,310 $8,801 $9,269 $9,759 EBITA 141 189 322 363 378 403 407

Step by Step Solution

There are 3 Steps involved in it

Seagate is undertaking this transaction to divest its Veritas shares and focus solely on its core rigid disk drive RDD business Divesting the Veritas shares in a separate transaction allows Seagate to ... View full answer

Get step-by-step solutions from verified subject matter experts