Question: Analyze the case presented and use it to develop/fill out the loan repayment spreadsheet. (3P Turbo case study). often sourced the equipment for production and

Analyze the case presented and use it to develop/fill out the loan repayment spreadsheet. (3P Turbo case study).

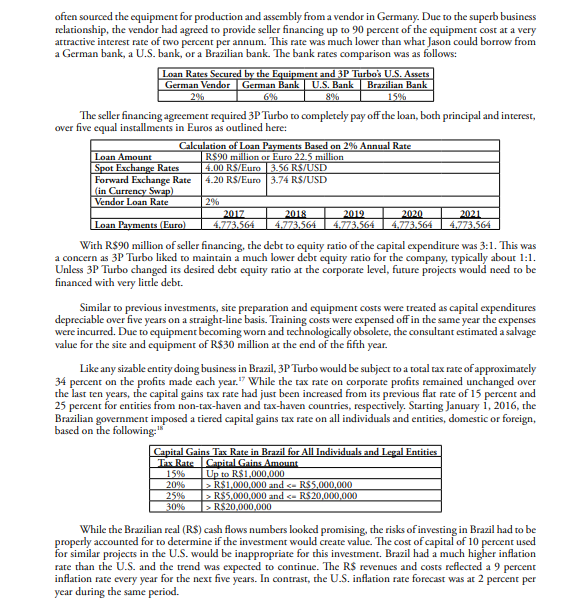

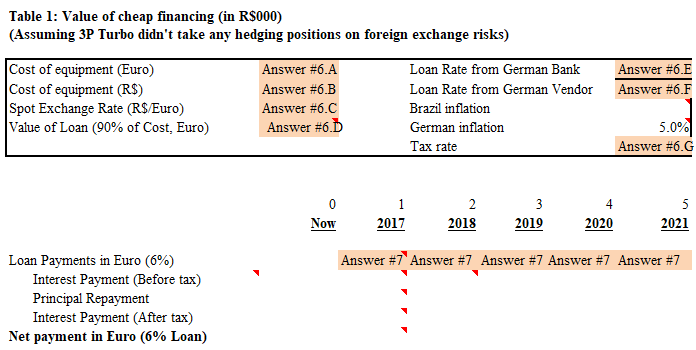

often sourced the equipment for production and assembly from a vendor in Germany. Due to the superb business relarionship, the vendor had agreed to provide seller financing up to 90 percent of the equipment cost at a very attractive interest rate of two percent per annum. This rate was much lower than what Jason could borrow from a German bank, a U.S. bank, or a Brazilian bank. The bank rares comparison was as follows: The seller financing agreement required 3P Turbo to completely pay off the loan, both principal and interest, over five equal installments in Euros as outlined here: With R $90 million of seller financing, the debt to equity ratio of the capical expenditure was 3:1. This was a concern as 3P Turbo liked to maintain a much lower debt equity ratio for the company, typically abour 1:1. Unless 3P Turbo changed irs desired debt equity ratio at the corporate level, furure projects would need to be financed with very little debr. Similar to previous investments, site preparation and equipment costs were treared as capical expenditures depreciable over five years on a straight-line basis. Training costs were expensed off in the same year the expenses were incurred. Due to equipment becoming worn and technologically obsolete, the consultant estimated a salvage value for the site and equipment of R $30 million at the end of the fifth year. Like any sizable entity doing business in Brazil, 3P Turbo would be subject to a total tax rate of approximarely 34 percent on the profits made each year. 17 While the tax rate on corporate profits remained unchanged over the last ten years, the capital gains cax rate had just been increased from its previous flat rate of 15 percent and 25 percent for entities from non-tax-haven and rax-haven countries, respectively. Starting January 1, 2016, the Brazilian government imposed a tiered capital gains tax rate on all individuals and entities, domestic or foreign, based on the following: 1s2 While the Brazilian real (R\$) cash flows numbers looked promising, the risks of investing in Brazil had to be properly accounted for to determine if the investment would create value. The cost of capital of 10 percent used for similar projects in the U.S. would be inappropriate for this investment. Brazil had a much higher inflation rate than the U.S. and the trend was expected to continue. The R\$ revenues and costs reflected a 9 percent inflation rate every year for the next five years. In contrast, the U.S. inflation rate forecast was ar 2 percent per year during the same period. Table 1: Value of cheap financing (in R\$000) (Assuming 3P Turbo didn't take any hedging positions on foreign exchange risks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts